Where is the big money in crypto applications: sector analysis and how to position your portfolio - PART 2

Welcome to Part 2 of our series “From Altcoin to Appcoin Season”

If you haven’t read Part 1 yet, click here: Part 1 – From blockchain to “Appcoin” season – there we looked at how quickly applications are overtaking blockchains in revenue, why the link between $BTC growth and app revenues is crucial, how “fees vs revenues” margins work, and why we believe the bottom is behind us.

Today we continue with a practical sector analysis:

Who is pulling in the most revenue today?

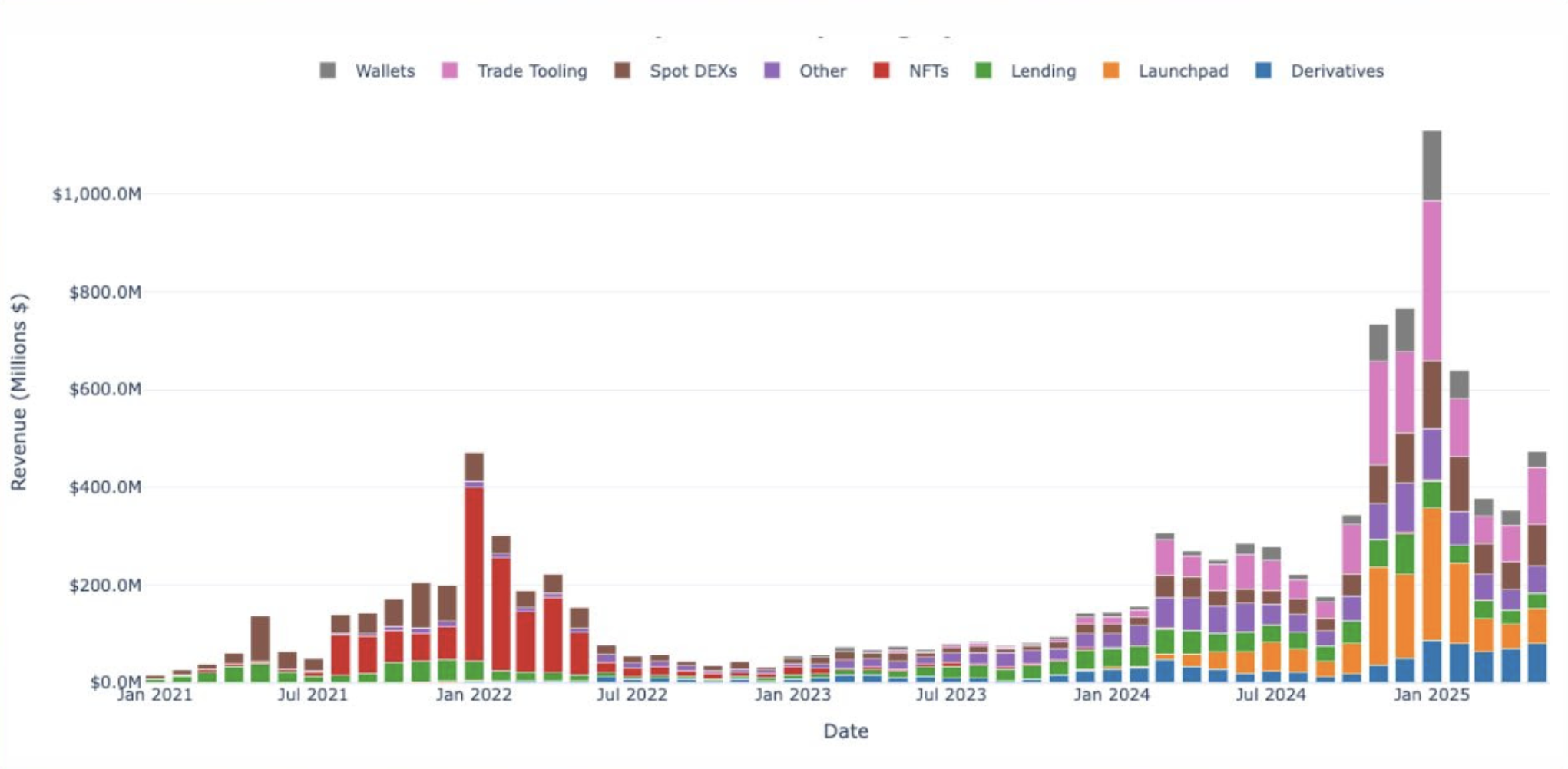

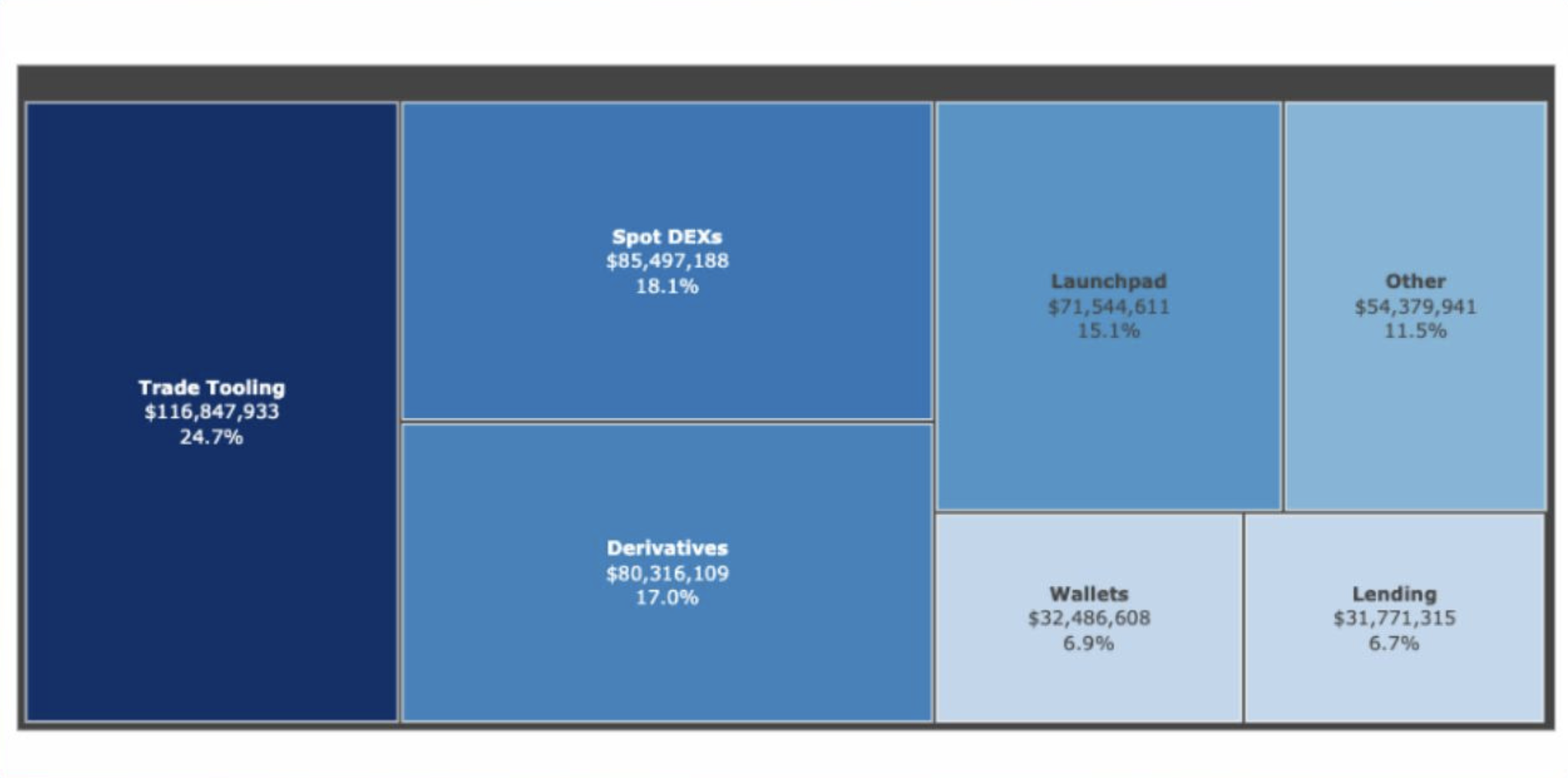

In June 2025 total crypto‑app revenues reached 473 million USD.

Here are the top 3 categories by share:

- Trade Tooling – $116.8 million (≈ 24.7 %)

- Spot DEXes – $85.5 million (≈ 18.1 %)

- Derivatives platforms – $80.3 million (≈ 17.0 %)

They are followed by Launchpads (~15 %), Wallets (~6.9 %), Lending protocols (~6.7 %) and other smaller categories.

Sector margins – who profits best

Trade Tooling – up to ~100 %

Lending – ≈ 26 %

DEXes – ≈ 13 %

* Margin = the share of collected fees that the protocol keeps as revenue

👉 High margin + rapid growth = a potential springboard for the token price.

Leaders setting the pace

Uniswap – the king of DEXes, but competition is knocking.

Aave – a lending pioneer with constant upgrades.

GMX – on‑chain derivatives, almost 100 % margin.

MakerDAO – a classic stable‑coin model with steady cash flow.

Helium and Render – DePIN projects with real users and revenue from network services.

How to catch the Appcoin wave?

- Focus on revenue‑positive tokens. Forget “hype‑only” coins.

- Diversify by sector, but prioritise those with high margins.

- Watch the correlation with $BTC. If you believe Bitcoin will grow, it makes sense to hold app tokens too.

- Use on‑chain data. Public dashboards (Token Terminal, Blockworks, etc.) show current revenues, margins and P/S ratios.

- Don’t ignore the macro picture. A bullish period = a chance to add risk, but keep capital for volatility.

Altcoin season 2021 was about blockchains. The next one will probably be the Appcoin season. Apps already show:

More users. More products. More revenue.

🤔 Ready?

Now is the time to position your portfolio and decide whether you’ll watch from the sidelines… or ride the wave.