Trump wants to change the rules of the game – what does this mean for Wall Street and crypto?

In the world of crypto, there’s always something happening…

But if we look closely – there are signals and events worth paying attention to.

Here are the events and moves in our focus this week. 👇

1/ Macroeconomics 🌎

This week will be full of news from the U.S. that could impact financial markets – including crypto.

- Tuesday: Retail Sales data – How did retail perform in August?

- Wednesday: Fed interest rate decision – A 0.25% cut is expected.

- Wednesday: Jerome Powell’s press conference – Important, as it will set the tone for future central bank decisions.

- Wednesday: Fed Dot-Plot Projections – Each Fed member will share their expectations for the number of rate cuts in 2025.

- Thursday: Initial Jobless Claims – Data on new unemployment benefit applications.

Although the main focus is Wednesday’s rate decision, the market will also pay close attention to details – Powell’s tone and exactly how many cuts other Fed members expect.

(According to CME’s FedWatch Tool, the market currently expects 3 cuts of 0.25% in 2025.)

2/ Corporate Earnings 💰

Crypto company Bullish ($BLSH) will publish its first quarterly report as a publicly traded company.

Why does this matter?

The more crypto firms show solid results → the more interest there will be from Wall Street → the more capital will flow into the sector → the higher the chance of price increases! 📈

3/ Politics and Regulations 🏛️

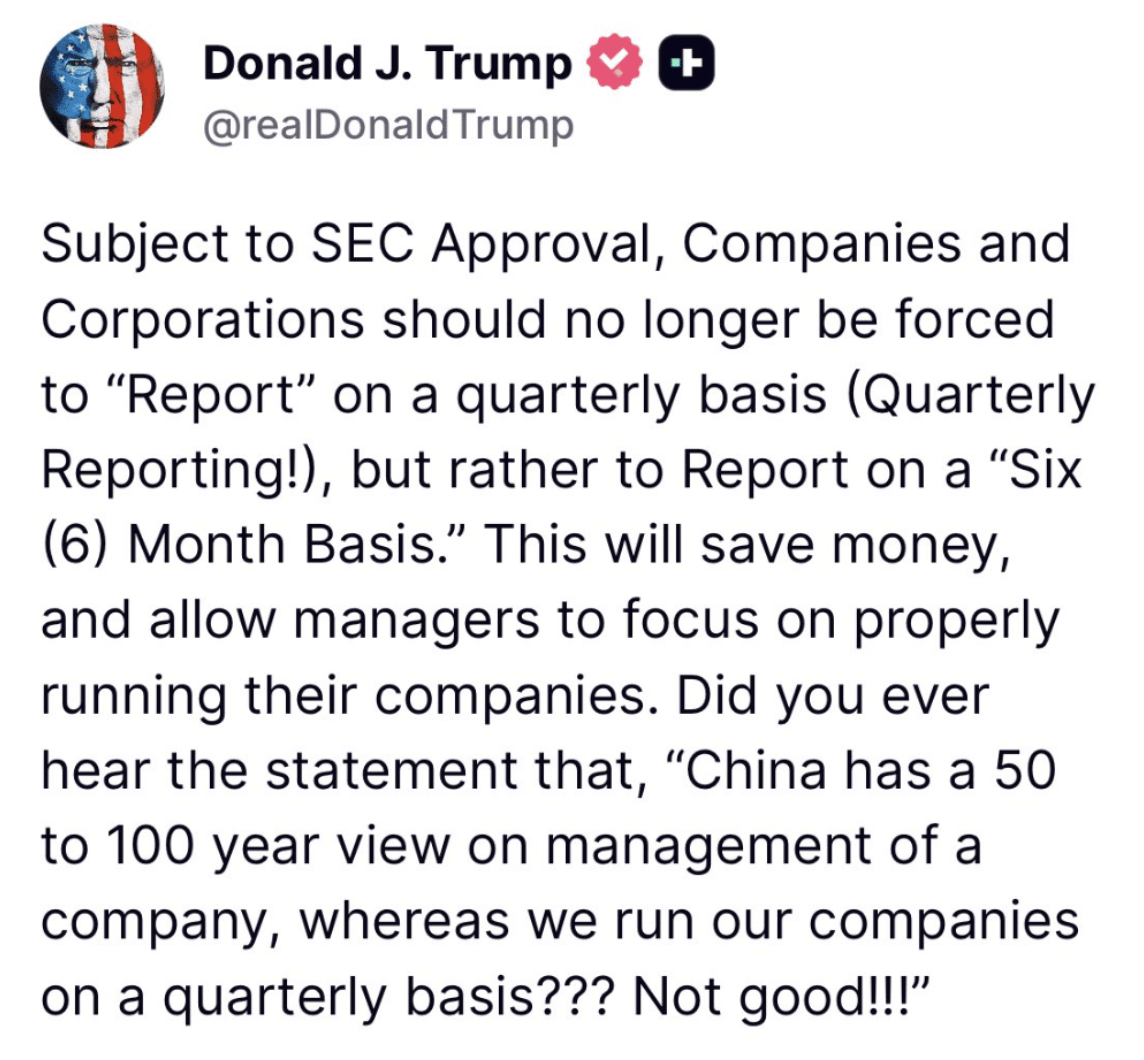

In the U.S., the discussion continues about how public companies should report.

President Donald Trump proposed switching from quarterly reports to semiannual ones.

The idea: companies and investors should focus more on long-term growth instead of short-term results.

A dynamic week lies ahead – with Fed decisions, key economic data, and corporate reports. All of these factors could impact not just traditional markets, but also crypto.

👉 Follow the Altcoins.bg blog to stay up to date with the most important developments.