Is the long-awaited altcoin season beginning?

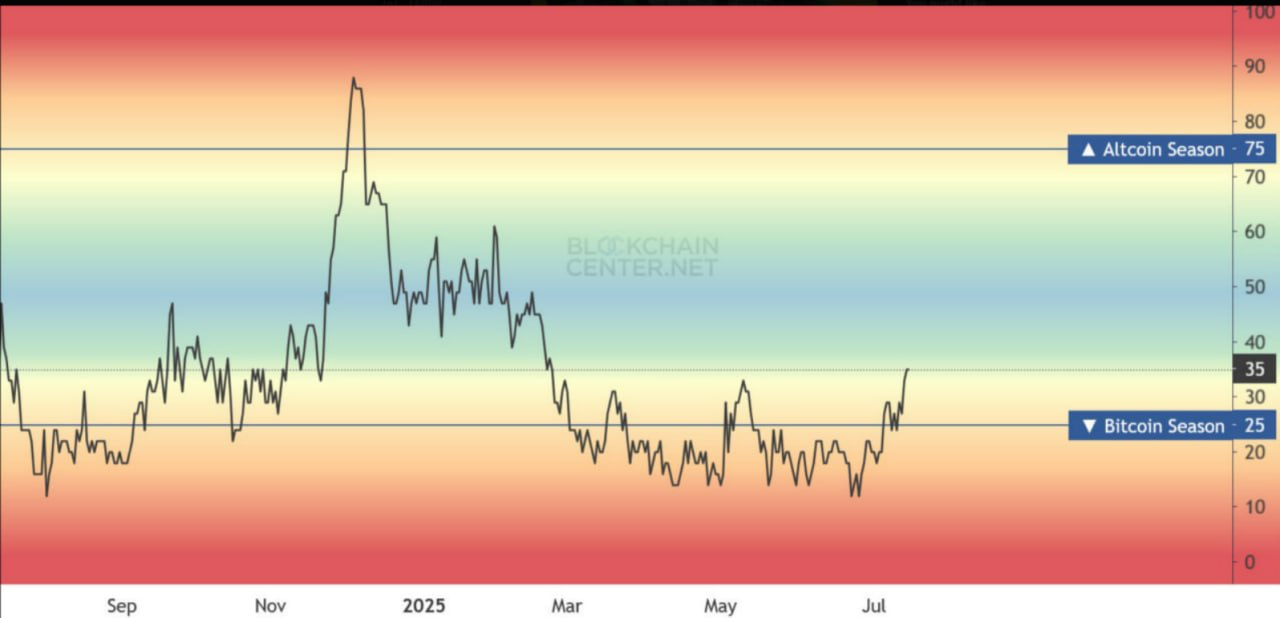

In the past few years, the phrase “altcoin season” has become somewhat of an inside meme in the crypto space. Every time Bitcoin makes a strong move or enters a consolidation phase, hope arises that this time altcoins will fly. But what do the data actually show today?

The truth is that in this cycle we’ve already seen several false starts. Altcoin enthusiasm was often followed by even lower lows. Many projects lost 80–90% of their value, some disappeared entirely, and market attention shifted almost entirely to Bitcoin, ETFs, and institutional news.

But something has started to change.

Max pain and delayed recovery

Over the past few months, altcoins seem to be consolidating at the bottom of a long and painful “max pain” scenario.

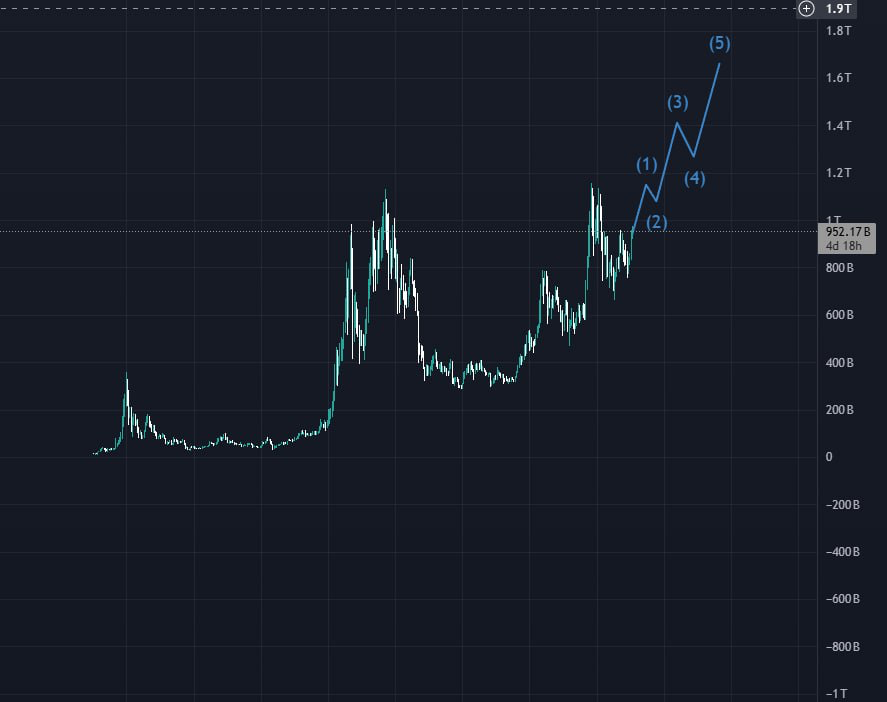

If we compare the chart of the total altcoin market cap (excluding Bitcoin) to that of Bitcoin itself, we’ll see that altcoins are lagging by about 9–10 months. That’s a significant delay that could create some interesting opportunities – if history repeats itself.

Why expect an altcoin season at all?

Skepticism is valid. But there are a few signals worth paying attention to:

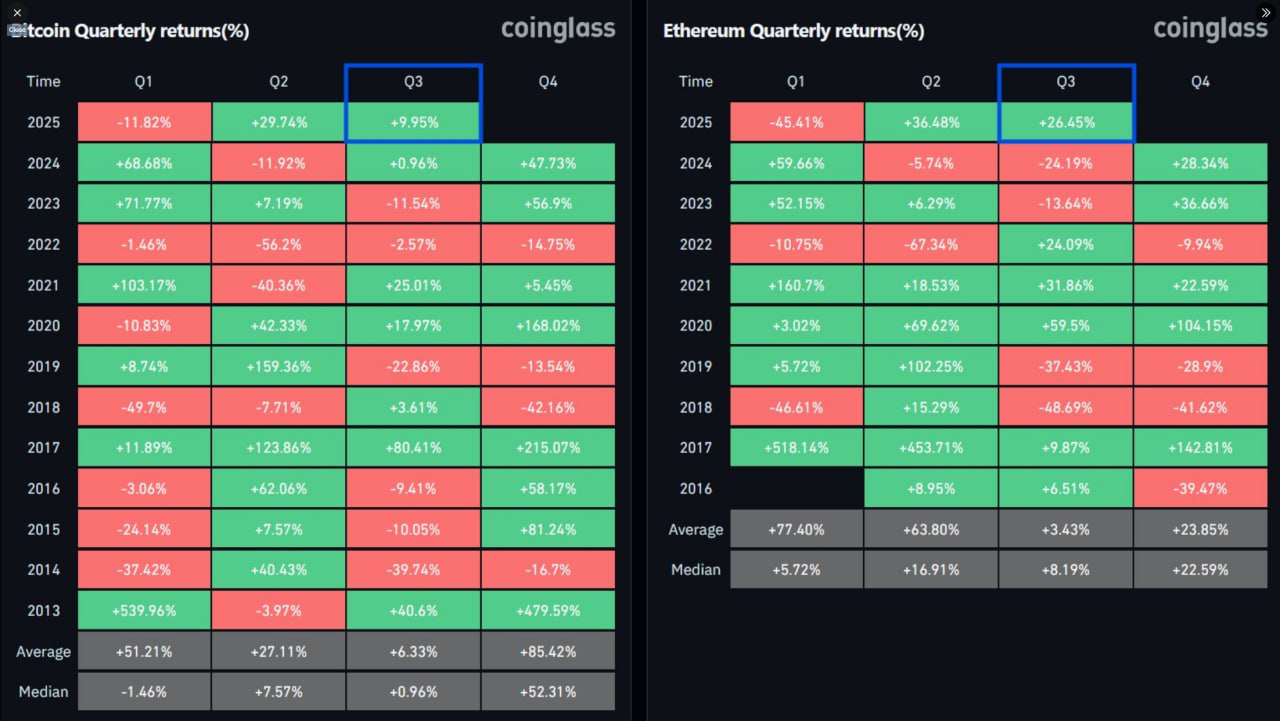

- Ethereum is outperforming Bitcoin in Q3 2025 – a sign that investors are starting to seek value beyond the first asset.

- The total supply of stablecoins on the market is steadily increasing. That means more capital is available, waiting for opportunities.

- Bitcoin dominance is still high, but starting to show signs of exhaustion.

- Investor mindset is shifting. When the market decides that Bitcoin is “too expensive,” capital inevitably seeks the next growth opportunities, often found in smaller projects.

What could trigger a real altcoin season?

The true altcoin season usually begins when:

- Bitcoin stabilizes around a new ATH.

- Institutions have already entered and have begun looking for “second-tier” assets.

- Retail investor waves return to the market.

That’s when the Bitcoin dominance chart starts to drop sharply – a signal that capital is rotating from BTC into alts. It’s usually at this point that altcoins start outperforming Bitcoin in terms of percentage gains, often within days or weeks.

Is it time?

The answer still isn’t 100% certain. But for the first time in a long while, we have a combination of technical and market signals suggesting something is brewing. And as always, the market rewards those who are prepared, not those who chase the FOMO.

If you want to stay on top of the market and not miss critical updates, subscribe to the Altcoins.bg blog, follow us on Telegram, and check out our guides on buying, storing, and identifying high-potential projects.