150 billion reasons to be bullish on ETH?!

Hello, friends!

Sometimes it's hard to get excited about crypto.

And not because crypto isn't exciting...

But because many of the important updates in the sector are buried in complex jargon. For example:

BlackRock filed to tokenize shares from a $150 billion fund in government bonds.

(Which, in plain English, means... what?!)

Let us explain simply:

BlackRock has a massive fund (for “big players only”) that holds government securities — meaning you lend money to the government and get a fixed return. Boring, but safe.

The minimum investment to enter the fund? $3 million. After that, clients can buy and sell whatever amounts they like.

🤔 Okay, but what does this have to do with crypto?

BlackRock plans to “tokenize” these assets — meaning every transaction will happen on-chain (on a blockchain network).

And according to most experts in the space, Ethereum is the most likely network they’ll use for this.

Here’s why this could be a mega bullish signal for Ethereum:

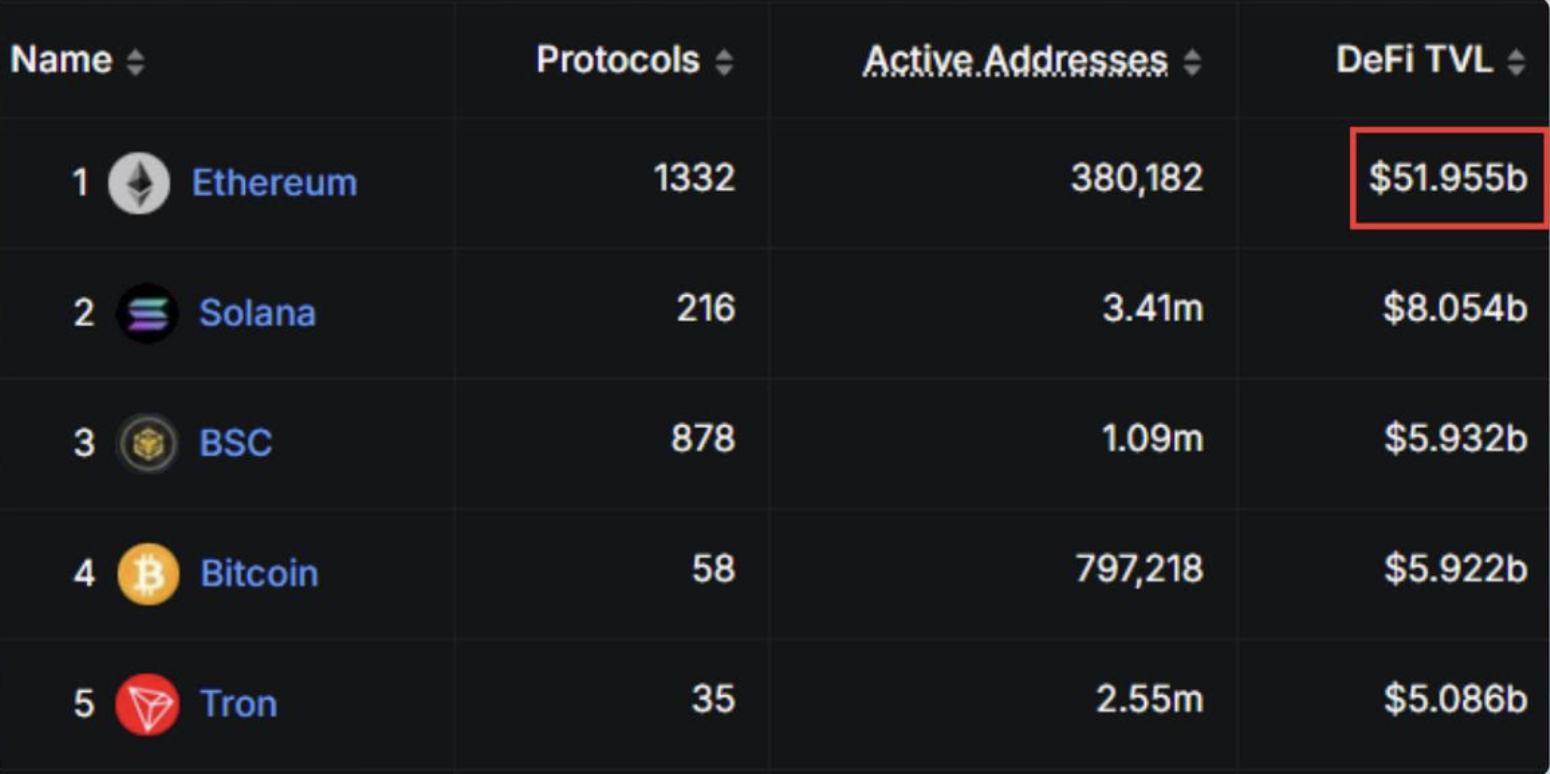

1. Total Value Locked (TVL)

Right now, around $52 billion is locked in Ethereum — this includes money deposited in DeFi platforms, apps, smart contracts, and so on.

If BlackRock tokenizes their full $150 billion fund, Ethereum’s TVL could jump to around $200 billion — nearly 4 times more than today!

For comparison: the second-largest blockchain by TVL is Solana — with only $8 billion.

A 4x jump for Ethereum? It would be hard for anyone to catch up at that point!

2. The Narrative

“The world’s largest asset manager moves $150 billion to Ethereum” — that’s the kind of headline that could breathe new life into $ETH and spark investor interest again.

3. The Snowball Effect

If BlackRock manages to tokenize this fund, other institutions will almost certainly follow.

And they’ll most likely choose the same blockchain network.

(Why change something that works perfectly?)

Now do you get it? This is a really big deal — it just sounds dry if you don’t translate it into normal language.

🔥 60% OF U.S. WEALTH STILL HAS NO ACCESS TO $BTC

If the first news got you bullish, let’s take it up another level…

You’ve heard that 2024 would be the year of institutional adoption of Bitcoin?

More accurately: it’s the year of the beginning of institutional adoption.

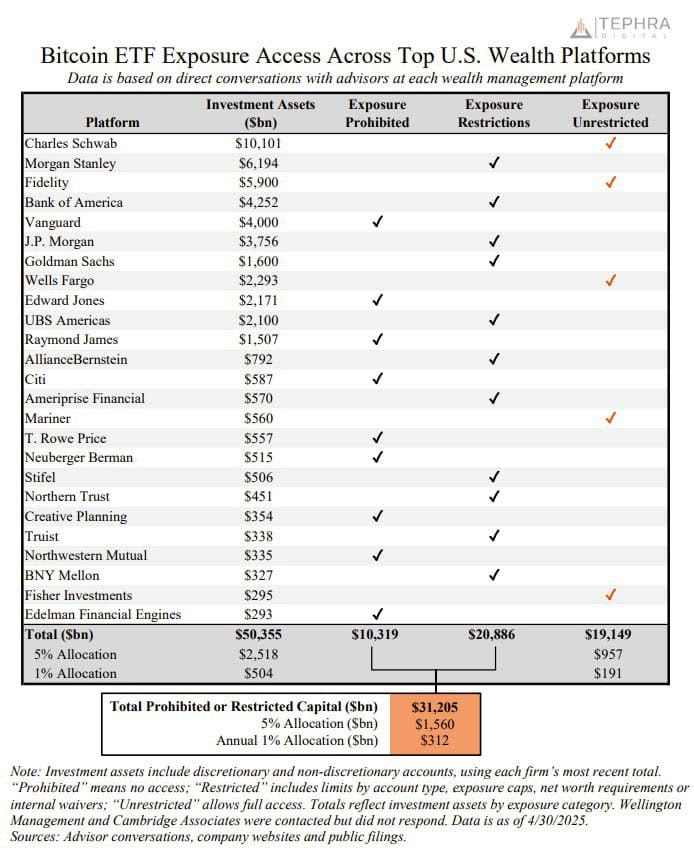

Tephra just published a chart showing that most major wealth management platforms in the U.S. still limit access to Bitcoin for their clients.

Which means one thing: the real party is just getting started! 🎉

What does this mean?

1. Around 60% of capital held in major U.S. wealth platforms:

👉 Has zero access to Bitcoin

👉 Or is heavily restricted in how much clients can invest

2. That 60% equals roughly $31.16 trillion currently cut off from $BTC!

3. If (or when) that money gets unlocked — a full shift isn’t even needed to spark change:

👉 A 1% allocation = $311 billion into Bitcoin ETFs

👉 A 5% allocation = $1.56 trillion into ETFs

(which is 13.5 times more than what’s currently there)

And yes, none of this is financial advice… but if institutions like BlackRock are moving toward Ethereum, maybe it’s time the everyday investor starts thinking about where they’re positioned. Sometimes the smartest moves happen before the headlines reach the mainstream.

Confused by some of the terms? Check our crypto dictionary. A good explanation can turn “sounds complex” into “wait, this might be an opportunity.”

Source: Milk Road