A story about a missed opportunity that every investor should hear

A few days ago we attended Eth Sofia 2, one of the most interesting crypto events in Bulgaria this year.

There we met someone who shared a story worth telling. A story that reminds us why in crypto the biggest enemy is often… our own hesitation.

He explained that back in early 2018 he had enough savings to buy 1 whole Bitcoin. At that time, the price had dropped from ~$19,500 to ~$7,000 and looked “too risky.”

Instead, he decided to invest just $500 and left the remaining $6,500 in the bank at a “safe” annual interest of 2%.

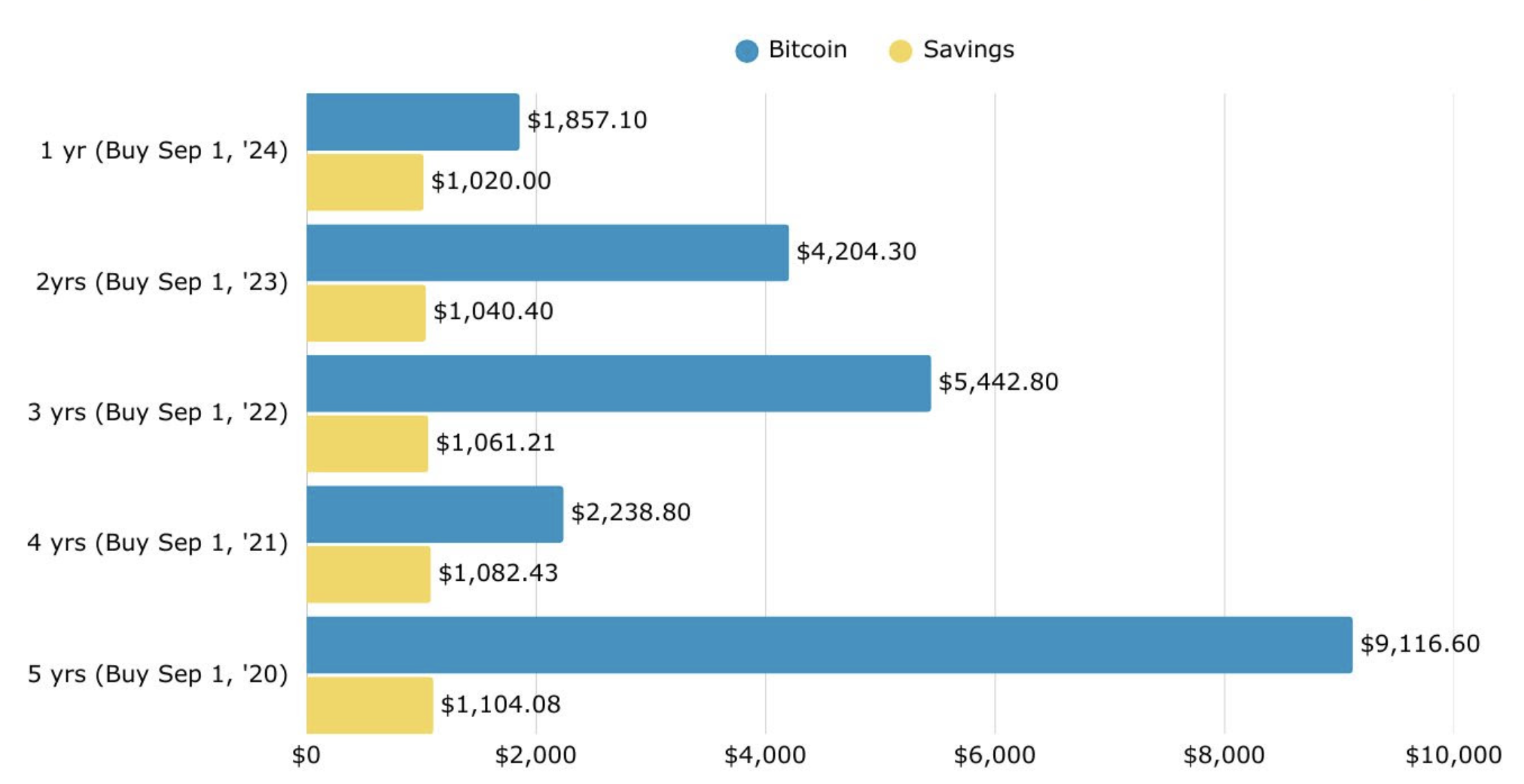

Today, when he compares the two scenarios, the result is clear:

👉 Bitcoin outperformed the bank interest rate by far!

Comparison between $1,000 in Bitcoin and $1,000 in a savings account (2% annual interest) over 1 to 5 years.

What did we learn?

This story reminded us that you don’t need to be a genius to profit from Bitcoin. What you need is patience.

Yes, the price will have its ups and downs, but time usually works in favor of those who don’t give up.

When to buy?

Alright, you’re convinced that holding makes sense. But when should you enter?

Here’s an unconventional method that has shown surprising results over the years:

Every time a major media outlet declares “Bitcoin is dead” – you buy $100 worth.

Sounds odd, but let’s do the math:

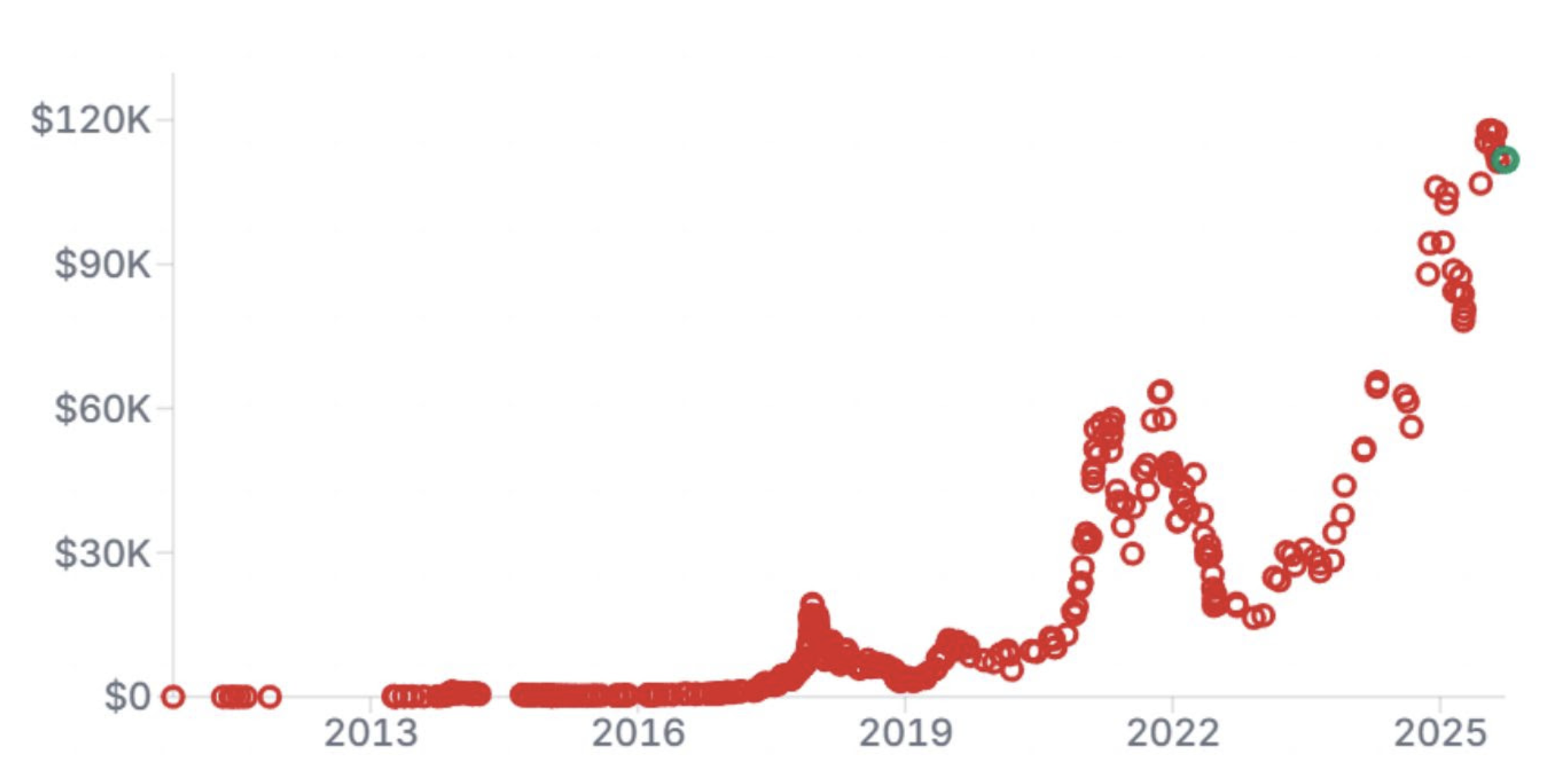

- In the past 15 years, Bitcoin has been “declared dead” 440 times according to Bitcoindeaths.

- If you had invested $100 each time, you’d have put in a total of $44,000 or about ~$3,000 per year.

- Today, this so-called “dead investment” would be worth… over $120 million.

Of course, nobody could realistically track every headline and buy every time. But it teaches us something important:

- The simplest way to get close to that result is to set up an automatic monthly purchase of around $250.

This is called DCA (Dollar-Cost Averaging) – a strategy where you invest a fixed amount every month, without worrying whether the market is at the “top” or the “bottom.”

How to apply it?

Will DCA bring the same results as in Bitcoin’s first 15 years? Probably not. But one thing is certain – it’s still a far better strategy than letting your savings earn symbolic interest in a bank.

The best part is that today you don’t need to follow the news, search for the “perfect entry point,” or worry about missing the next big rally. With automated investing, you can set a small fixed amount every month and let time do the work.

At Altcoins.bg we now offer exactly this – fully automated recurring purchases. You choose the amount, and we handle the execution. That way, you don’t have to wonder if the market is at the “top” or the “bottom” – discipline and consistency do all the work for you.

Learn how: Automate your crypto investments TODAY!

And here lies the big difference: while a bank may give you 2% interest per year, cryptocurrencies offer the chance to participate in one of the fastest-growing markets in the world over the past decade. Yes, there is volatility and risk, but that’s exactly why DCA is so valuable – it smooths out fluctuations and keeps you in the game long term.

In the end, the choice is yours: let your money “sleep” or give it the chance to work for you. The story we heard at Ethereum Sofia 2 is proof of how important timely decisions can be.

In crypto, it’s not the one chasing every peak who wins, but the one who stays patient and consistent.