The macro picture is changing: a crucial week for the crypto market

After several weeks of uncertainty and delayed data due to the U.S. government shutdown, the macroeconomic picture returned in full force this week.

And the first strong signal is already here.

U.S. unemployment hits 4.6% – the highest level since 2021

On Tuesday, the November Jobs Report was released, showing that U.S. unemployment has risen to 4.6%, the highest level since September 2021.

This is a key moment, because markets have been closely watching the labor market for months as an indicator of whether the Federal Reserve has room for further rate cuts.

Higher unemployment = weaker economic activity

Weaker activity = less inflationary pressure

Lower inflation pressure = higher probability of future rate cuts

Historically, this combination has often been positive for risk assets.

What we are watching for the rest of the week

With Tuesday’s data already behind us, the focus now shifts to inflation, consumer behavior, and Japan.

CPI and PCE: inflation under the microscope

- CPI (Consumer Price Index) – Thursday – a closer look at inflation for November

- PCE (Personal Consumption Expenditures) – Friday – the Fed’s preferred inflation indicator, offering a broader view for October

If both indicators continue to cool, the market is likely to strengthen expectations for a more accommodative monetary policy in 2026.

The consumer and housing: signs of fatigue?

On Friday, several “pulse” indicators will also be released, providing context on how the real economy is performing.

- Existing Home Sales – a check on the health of the housing market

- Michigan Consumer Sentiment – how consumers actually feel, not just what the data suggests

These figures do not always move markets directly, but they often show whether the slowdown is being felt beyond the headlines.

The major risk factor: Bank of Japan

Friday also brings the decision of the Bank of Japan (BOJ), with markets almost fully pricing in a 0.25% rate hike.

The reason this matters for crypto markets is simple.

For years, investors have relied on the yen carry trade:

- borrowing cheap yen

- investing in U.S. stocks, technology, or crypto

Higher rates in Japan make this strategy more expensive and can lead to position unwinding, including in crypto assets.

The good news is that this move has been expected since the beginning of the month and is likely already priced in, reducing the risk of a sharp reaction.

What the charts are telling us

From a technical perspective, the picture remains stable.

- Bitcoin closed another weekly candle within its upward trend

- The bullish trend remains intact, at least for now

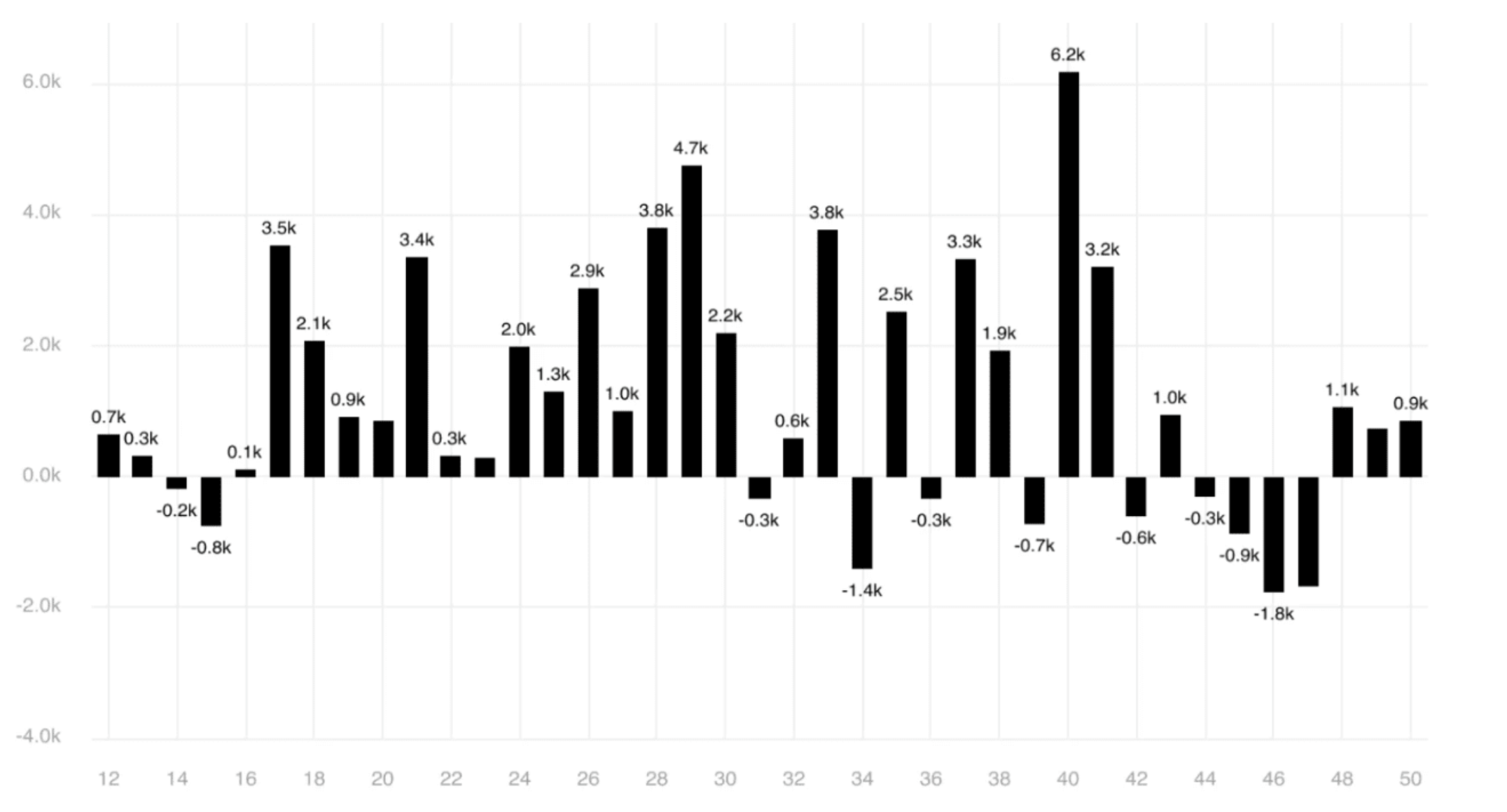

- Crypto flows recorded a third consecutive week of positive net inflows

This suggests that risk appetite is gradually recovering rather than disappearing.

The bigger picture

The combination of rising unemployment, cooling inflation, and a stable technical trend in Bitcoin creates an environment where the crypto market is not under direct pressure, but rather in a phase of consolidation and accumulation.

Future moves will depend not on a single data point, but on whether macro signals continue to align in the same direction.

That is exactly why the coming days remain critical for market direction through the end of the year.

If you want a broader perspective on what will actually drive the crypto market next year, which trends are just beginning to emerge, and why 2026 could be pivotal for the entire sector, we recommend reading our previous article: 3 market trends that will drive crypto in 2026.

There, we explore the bigger picture beyond daily news and short-term price movements.

If you want not just to follow the market, but to understand what’s happening and how to react in time, the Altcoins.bg platform offers an easy and secure way to buy, sell, and manage crypto assets with local support and clear conditions.

Whether you are taking your first steps or are already active in the market, everything you need is in one place.