Why did the crypto market crash yesterday and what awaits us in December?!

You wake up feeling good, ready for a strong crypto December.

You check your phone… and suddenly see a 5 percent drop in Bitcoin and almost the entire market. That’s how we all woke up yesterday...

What happened?

It turns out the reason has nothing to do with crypto, technology, or any negative news flow.

The main culprit is Japan and the Bank of Japan's decision regarding a potential rate hike.

What exactly happened in Japan

The market is currently pricing in around a 73 percent probability that the Bank of Japan will raise its benchmark interest rate on December 19.

Yes — a hike, not a cut.

This surprised everyone, because Japan has maintained near-zero rates for more than two decades.

Even the expectation of a hike was enough to push the yield on Japan’s two-year bond to 1.84 percent, the highest level since 2008.

In simple terms: Japanese markets entered strong panic mode.

What does this have to do with crypto

This move threatens one of the oldest and most important global liquidity mechanisms:

The Yen Carry Trade.

In short:

- investors borrow yen at near-zero interest

- allocate the funds into higher-yielding assets (such as US bonds)

- pocket the difference as an almost “risk-free” profit

If the Bank of Japan hikes rates, the model breaks.

Investors begin closing positions, returning borrowed yen, and reducing risk.

That’s exactly what led to yesterday’s sell-off across global markets, including crypto.

The same thing happened in August 2024.

Important: crypto fundamentals have nothing to do with this drop.

This is purely a macro shock. Equity indices fell as well.

Should we be worried

The short answer is: no.

Nothing in crypto is broken. No network failures, no negative ETF news, no technological issues.

In other words, the decline came from outside factors — not from the industry itself.

The long-term outlook for 2026 remains completely intact.

What to expect in December

Day 1 wasn’t great, but the month is just beginning and several potentially strong events lie ahead.

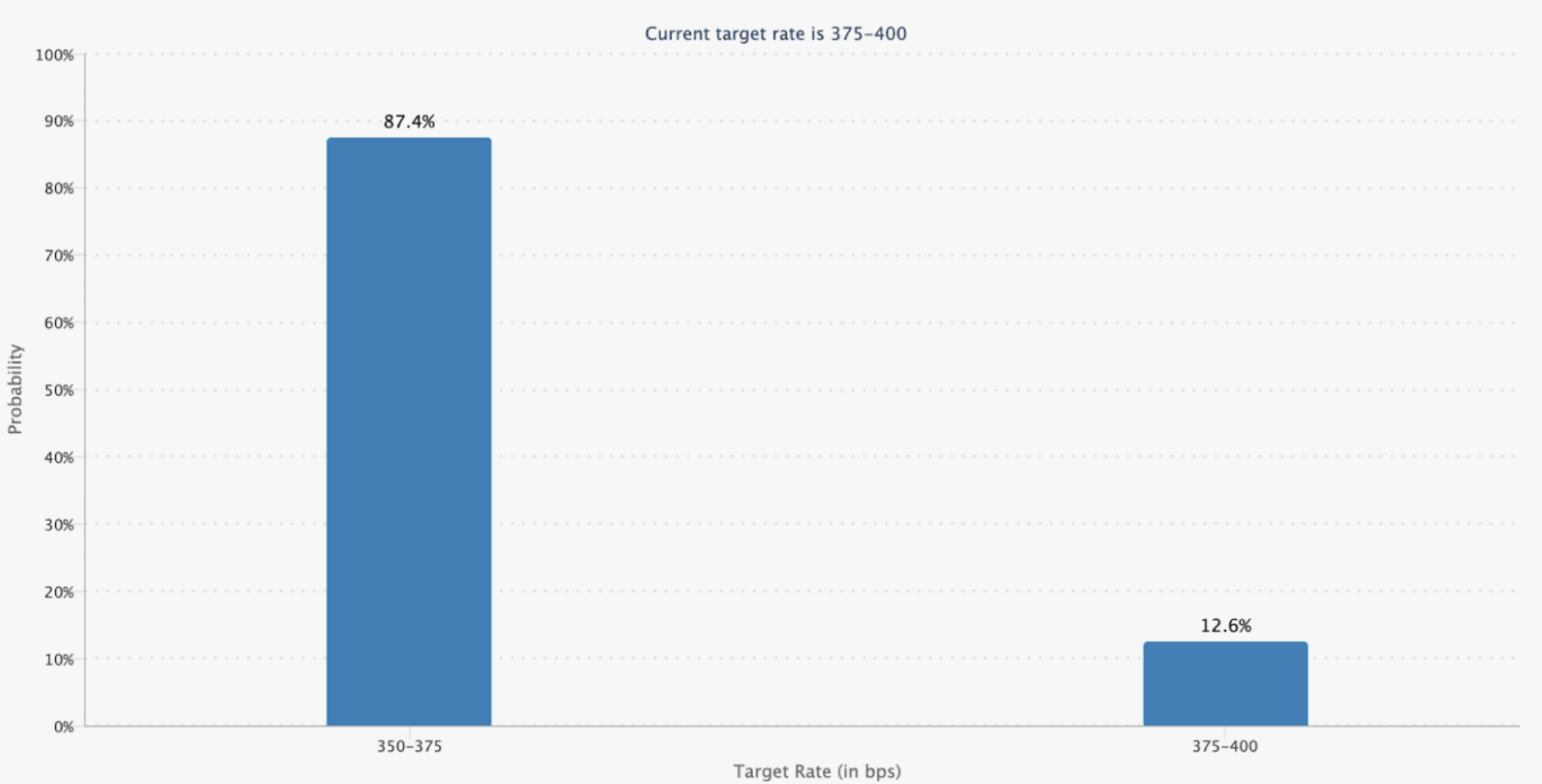

1. The Fed’s rate decision, December 10

The probability of a rate cut is around 87 percent.

More important is what Powell will say about 2026 and future easing cycles.

The new chair is generally more inclined toward economic stimulus, which markets like.

2. Bank of Japan’s rate decision, December 19

This is currently the biggest macro risk event.

More than a 70 percent chance of a hike means the Yen Carry Trade could be shaken further.

This would affect all risk assets, including crypto.

3. End of QT and start of light QE, December 1

Last night Quantitative Tightening officially ended, meaning the central bank is no longer pulling liquidity out of the financial system.

Even better: forecasts point to a slight return to QE, which adds liquidity to the markets.

Historically, this supports risk assets like BTC and ETH.

4. Solana Breakpoint, December 11–13

One of the most important annual events for Solana.

Historically, Breakpoint often brings:

- partnerships

- new projects

- software announcements

- growth in the Solana ecosystem

It frequently reflects positively on SOL.

What all of this means for investors

December is loaded with macro and crypto events.

Volatility can be sharp — in both directions.

But the most important points are:

- Crypto fundamentals are stable

- Liquidity may improve

- Key ecosystems like Solana are entering a strong period

- The market issue comes from outside, not from within

Panic here is not justified.

If you want to follow the market without panic

If you want the market to stop catching you off guard, join the Altcoins.bg Telegram group.

There we share important news and real discussions that can save you time, stress, and money.

Join if you want a more informed view of the market.

If you want to understand how investors determine when the market shifts from normal volatility to real risk, we have an article covering the four key factors that signal a potential SELL. These are indicators that often reverse the trend even when everything looks calm. It’s worth reading if you want clearer guidance on what the broader crypto community is watching.