How to Verify a Business Account for Buying and Selling Crypto on Altcoins.bg

To start buying and selling cryptocurrency as a legal entity (a company) in Altcoins.bg, you must first create a FREE business registration on the platform.

This can be done here:

Register a Company Account on Altcoins.bg

Please note that when registering a company account with us, it must be created by the owner (manager) of the company or an officially authorized representative.

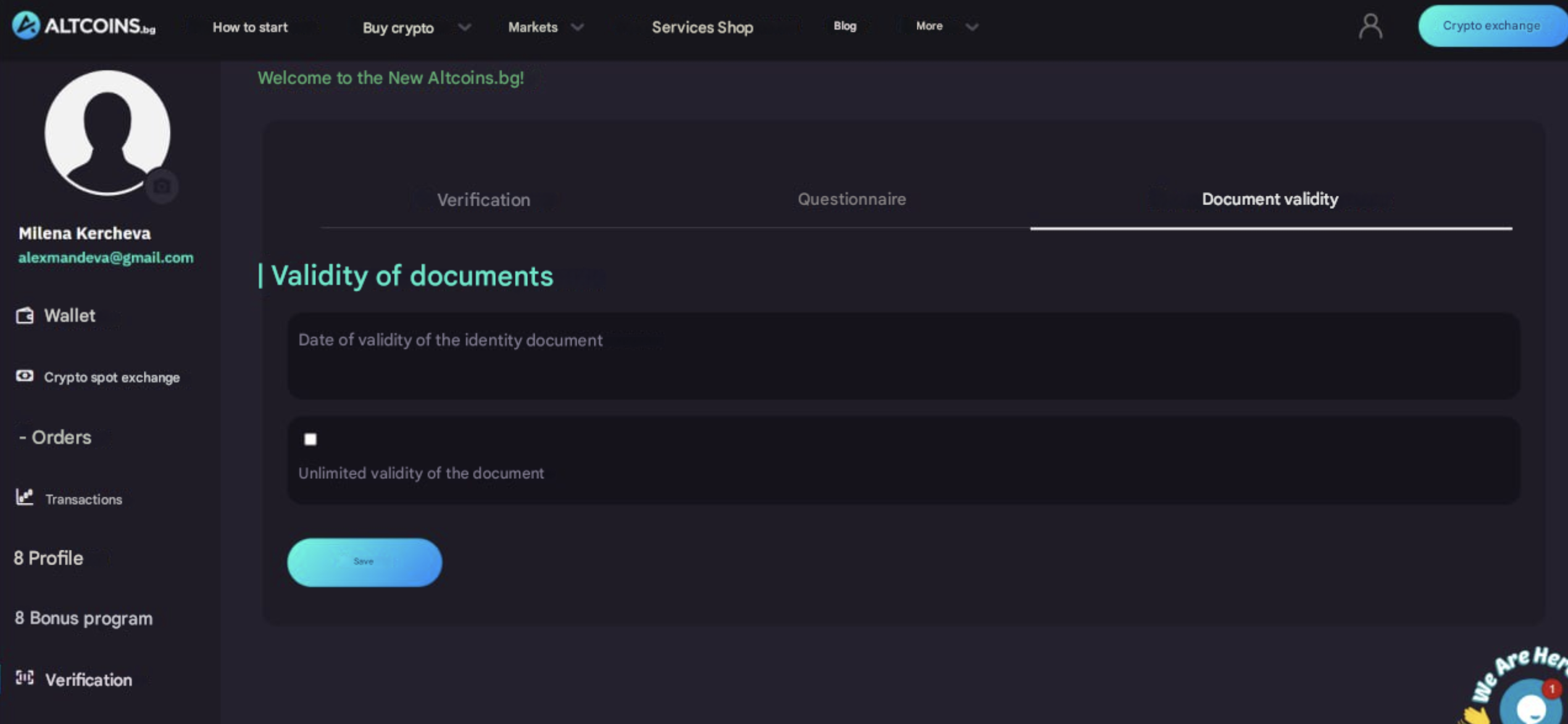

After completing the initial registration, the next step is to verify the account. This is done using the ID document of the person on whose behalf the crypto trading account was registered. Full instructions can be found in the article below:

How to Verify Your Profile in Altcoins.bg?

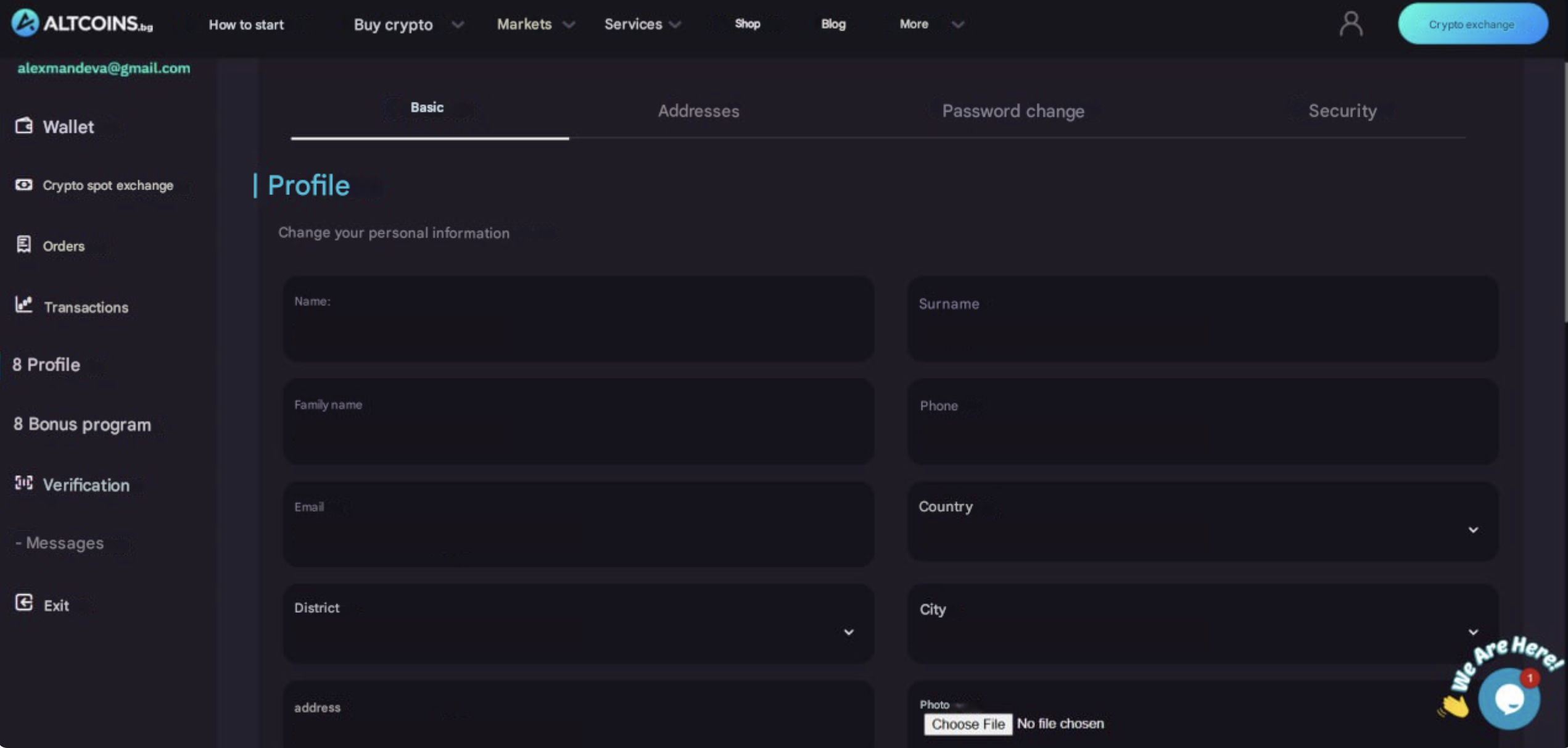

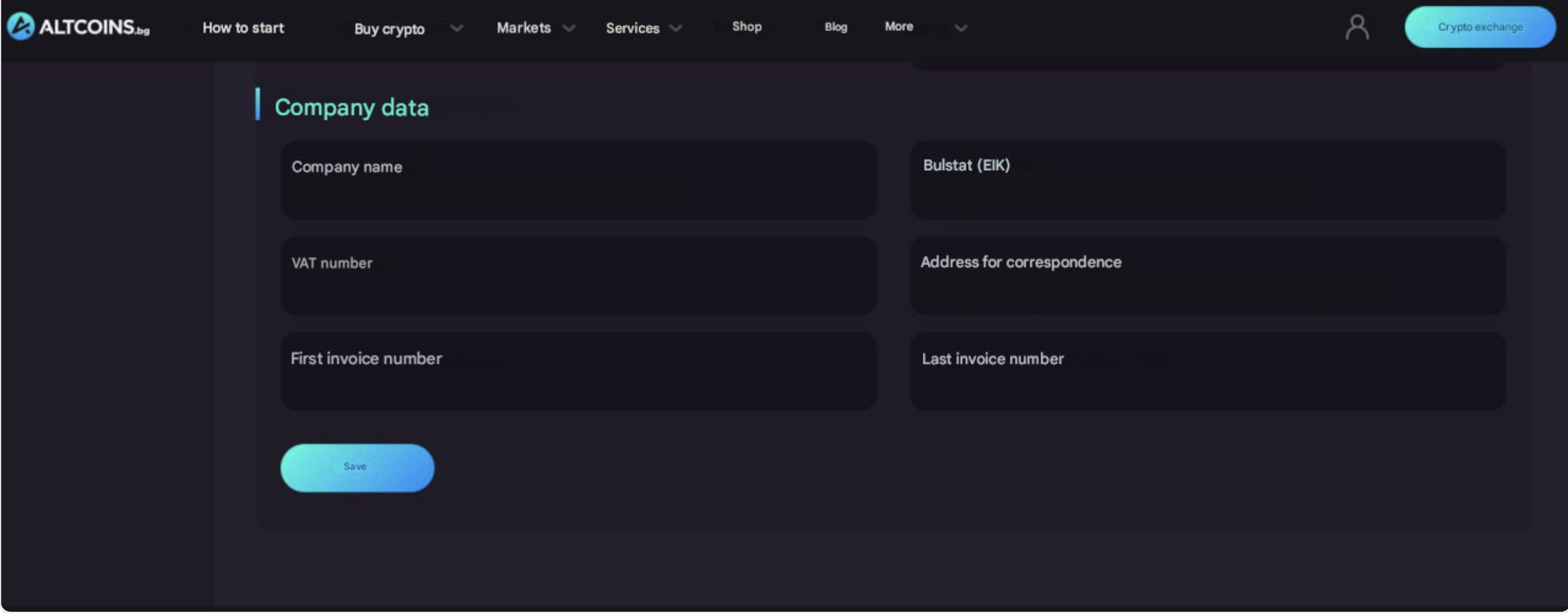

The next step is to fill in the details shown in the images below. This is all the information we need to start issuing an invoice on your behalf for every completed crypto sale order.

All fields contain standard information. The only part that requires additional explanation is the "First and Last Invoice Number". Here is a small tip:

If your paper invoices start with 0 and your electronic invoices start with 1, please give us a numbering sequence starting with 2, 3, and so on.

You already know that invoice numbers must not be duplicated. Using a completely separate numbering sequence for your crypto activity is the best approach. That’s it! It’s really that simple.

It’s important to note that cryptocurrencies are considered a financial instrument, and issuing invoices for them is not mandatory. However, for the sake of both your accounting and ours, it is always better to keep everything in perfect order.

Your IBAN should be entered in the "Addresses" section inside your business profile settings. Once saved, the bank account will automatically appear in your orders so you don’t have to enter it manually every time.

After completing this step, the registered email address will receive a set of documents that will allow us to learn more about your company and the purpose of your relationship with us. This includes:

1. Client File.

2. Declaration of the Company’s Ultimate Beneficial Owner.

3. Declaration of Source of Funds.

4. Declaration of Politically Exposed Person (PEP) Status.

Below you will find detailed instructions on how to complete each document:

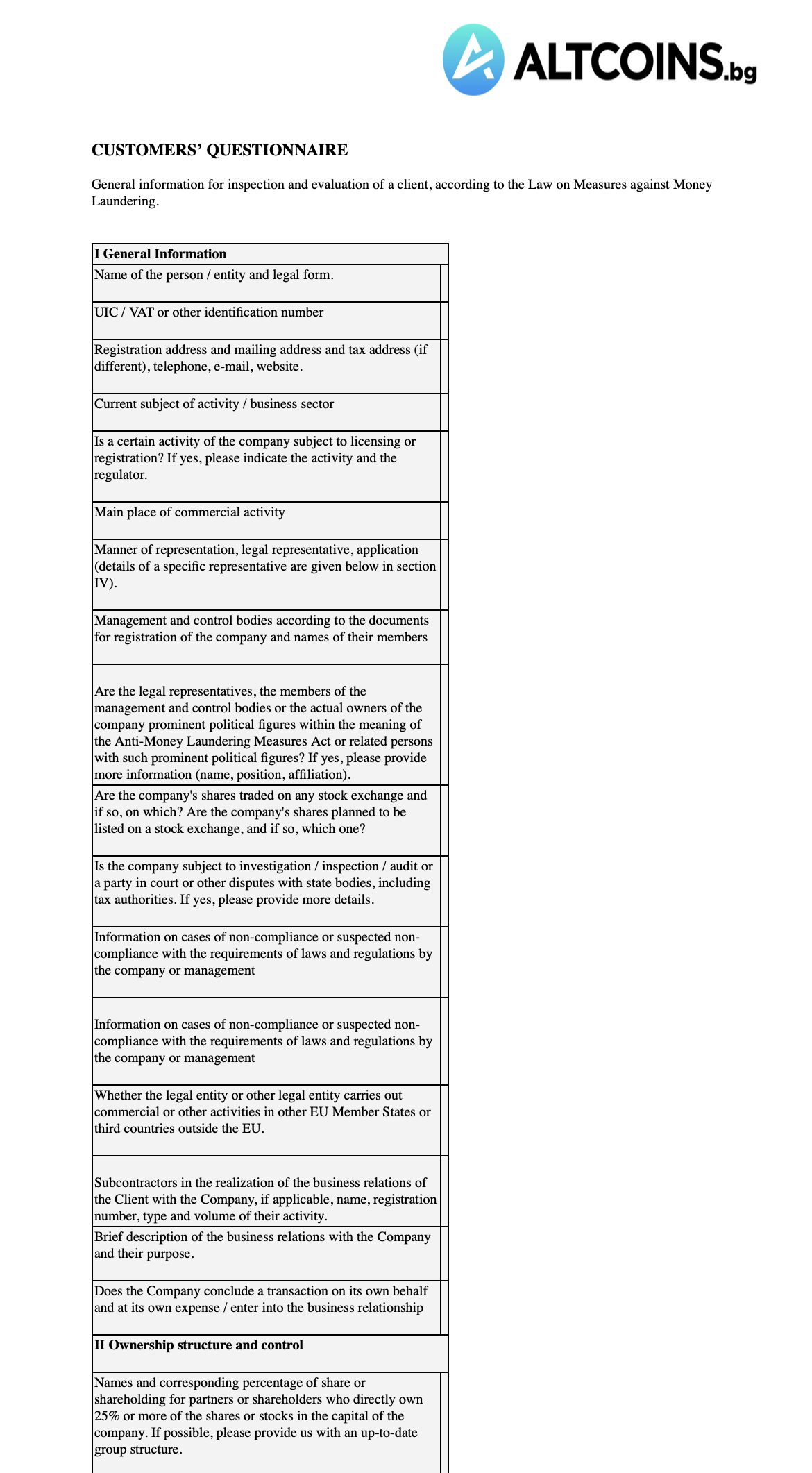

Client File

This document requires you to fill in the general company information as follows:

Company: Company name

Legal form: ET, EOOD, OOD, AD, etc.

Registered address:

Correspondence address (if different):

Current business activity:

Purpose and nature of business relationship: Buying and selling cryptocurrency

Term of existence: Write “indefinite” unless your company has been registered for a temporary project and will be closed afterward.

Management and controlling bodies: Manager, Management Board, Board of Directors, etc.

Type and composition of any collective management body (if applicable)

Main place of business:

Ownership structure: According to the Ultimate Beneficial Owner declaration.

The section “Data of the legal representative / authorized person” below should be straightforward.

The next document is:

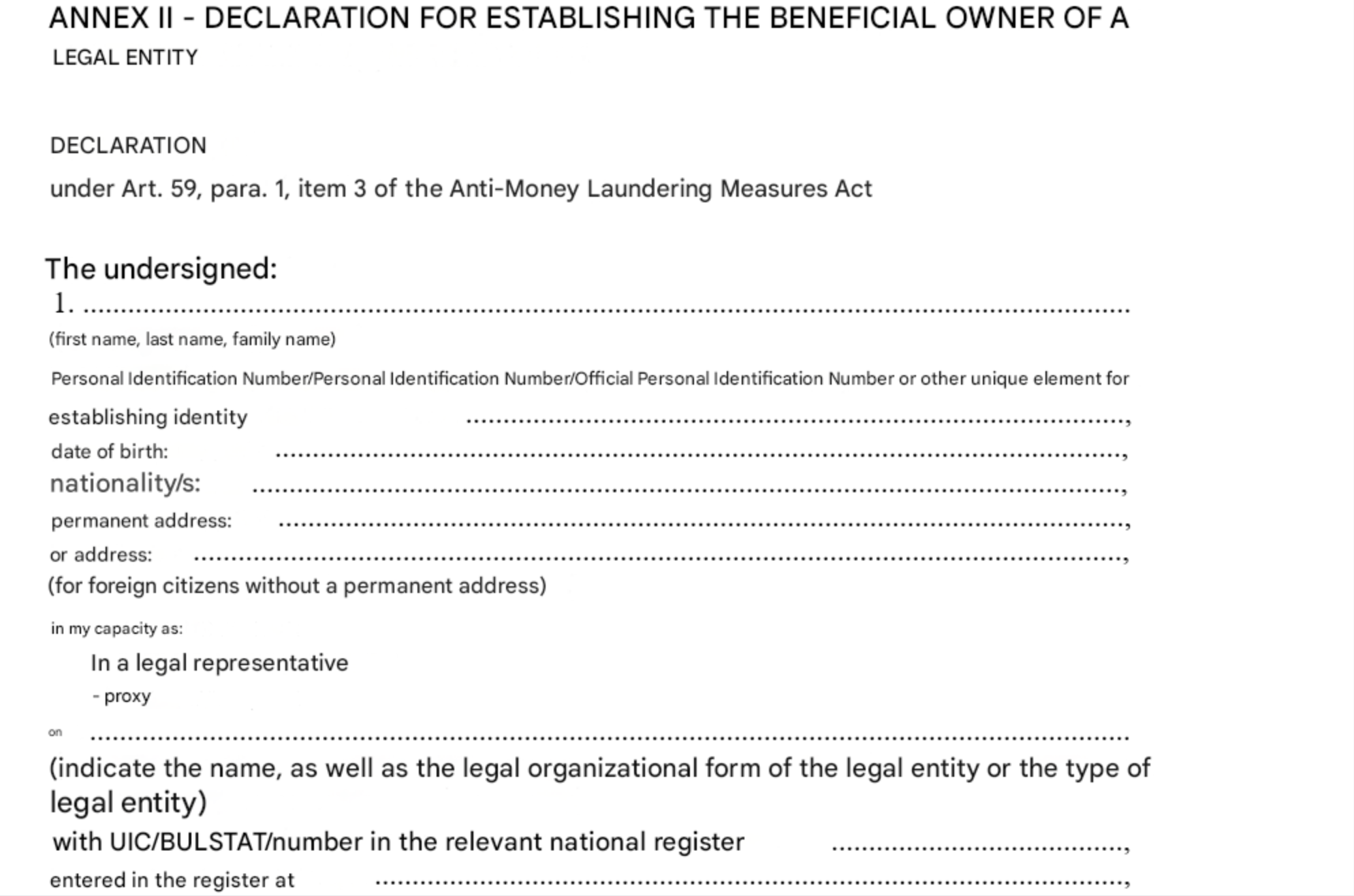

Declaration of Ultimate Beneficial Owner

The purpose of this document is to identify the actual owners of the company and how ownership rights are distributed.

The first section should be simple. It is filled out by the Manager or authorized representative who registered the account.

It indicates whether the person is a legal representative or a proxy.

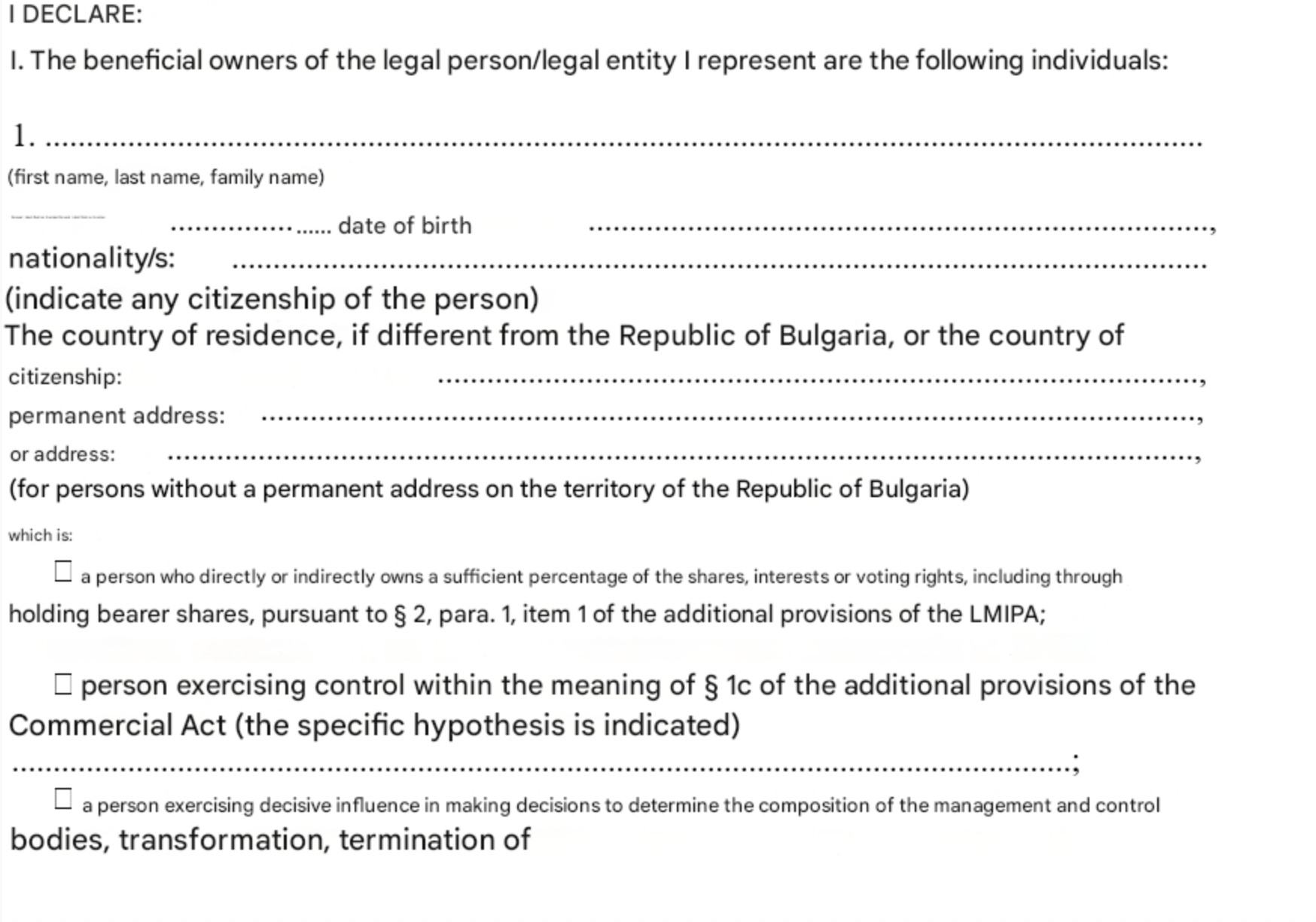

Section I lists the individual shareholders of the company.

You must specify the percentage of shares owned.

If the company is an EOOD (single-owner company), only the manager’s information is required.

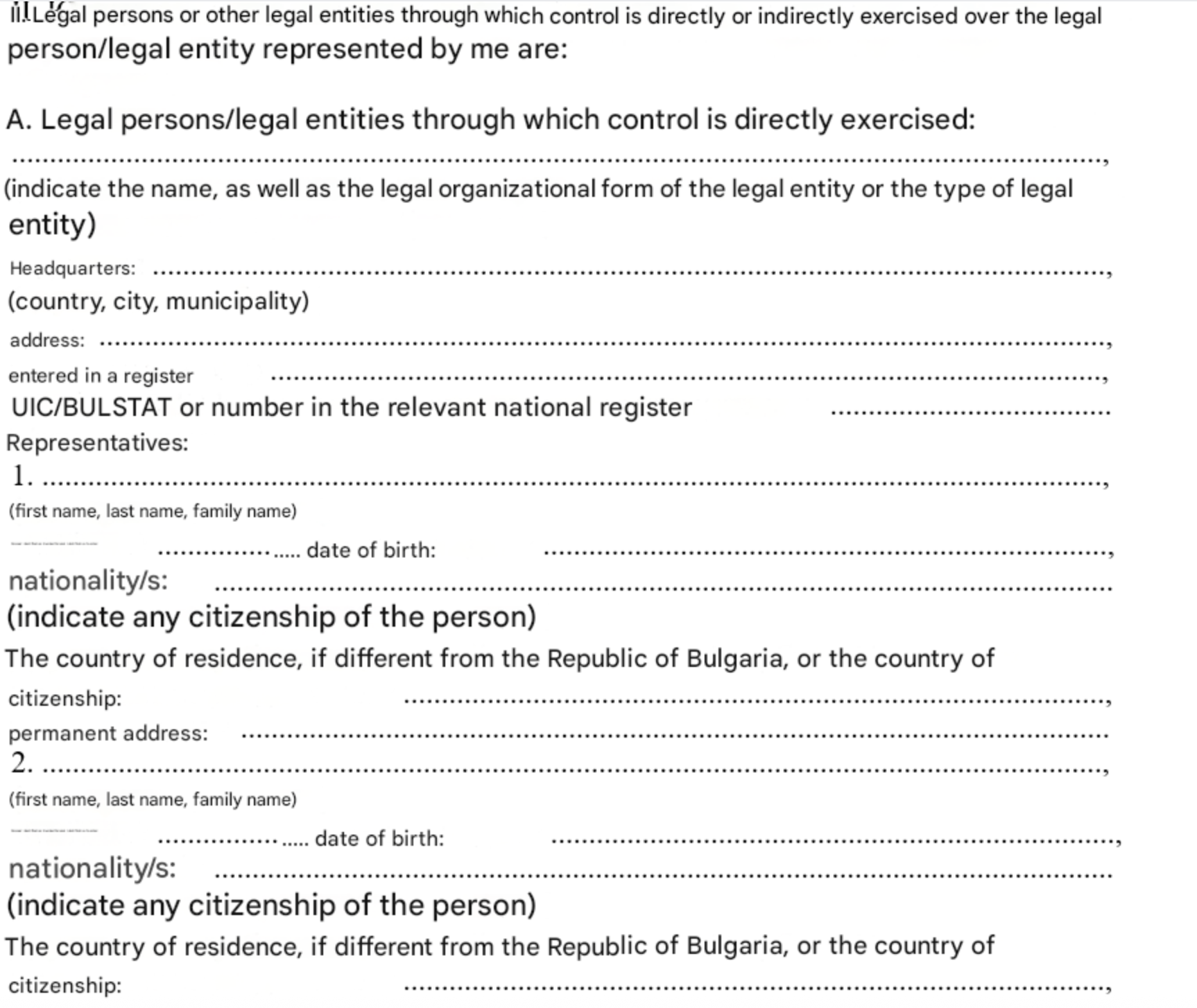

Section II is for legal entities that own a percentage of the company.

If your company has no such entities, you leave this section blank.

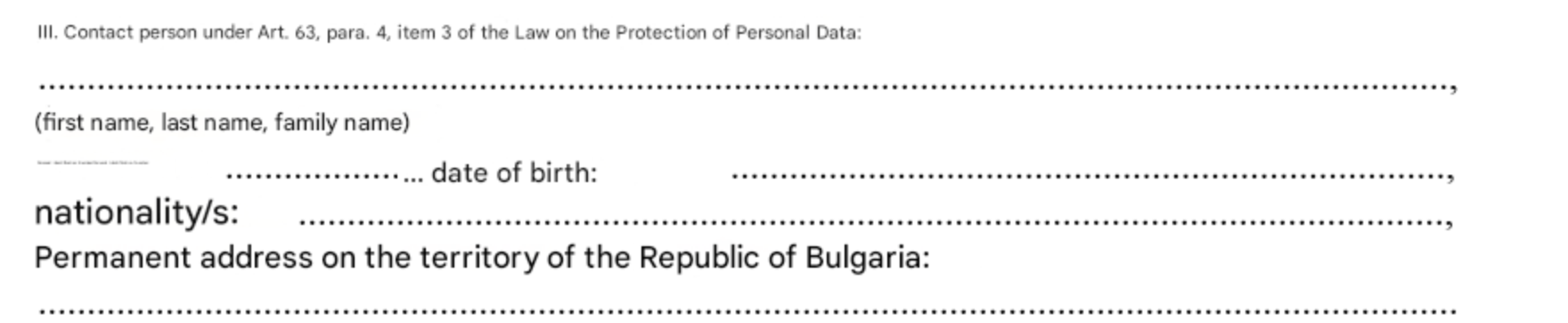

Finally, Section III must be completed.

This section again requires the details of the Manager or another person appointed for this purpose.

The next document in the set is:

Declaration of Source of Funds

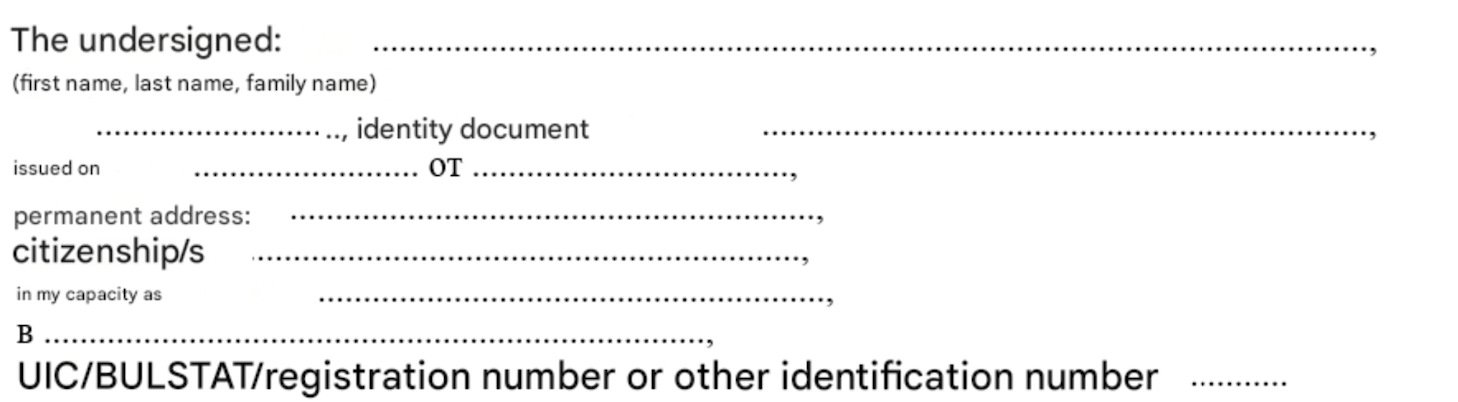

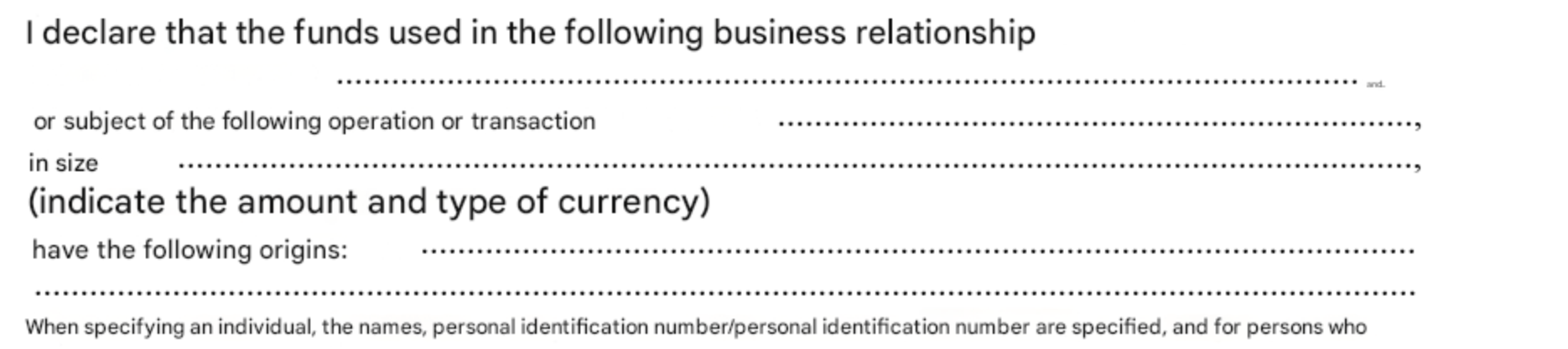

This section is straightforward. Enter the details of the Manager / Authorized Person who will operate the account on our platform.

Next, describe the nature of your relationship with us, your transactions, and the source of the funds used:

Nature of relationship: Buying and selling cryptocurrency on Altcoins.bg

or subject of the following transaction: Leave blank unless you plan to complete only one transaction with us. If that is the case, enter the order number here.

Amount: For companies we typically write: “Over 30,000 BGN.”

The purpose of this is to prevent your account from being temporarily paused for additional checks when reaching the legal threshold of 30,000 BGN.

Funds originate from: Here you describe the source of the money you will use for buying / selling cryptocurrency with us.

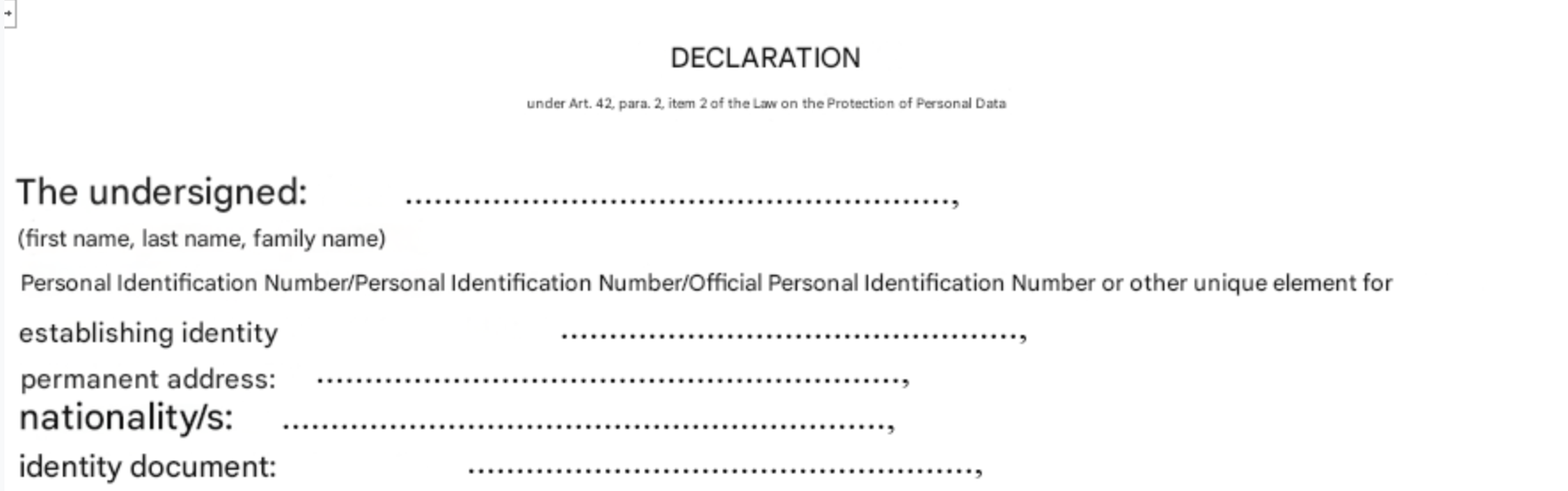

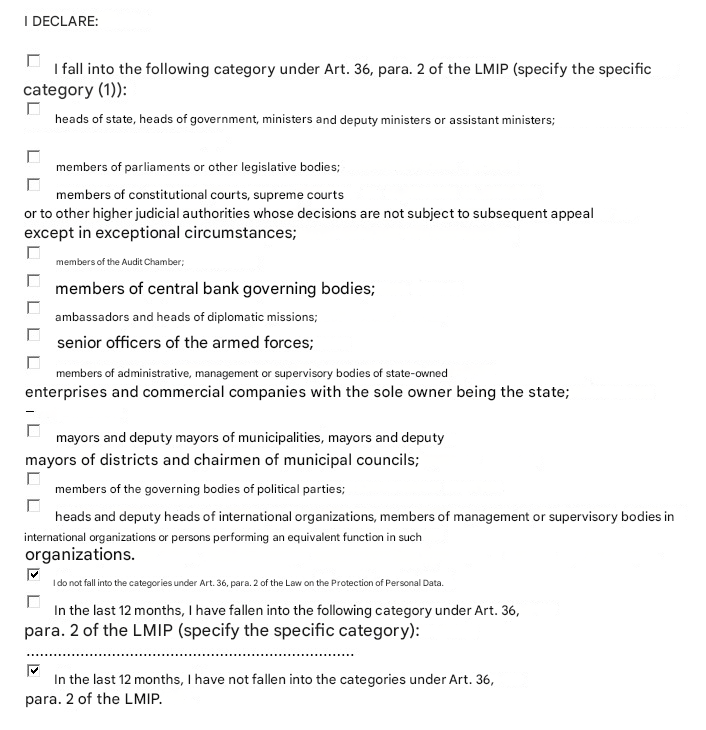

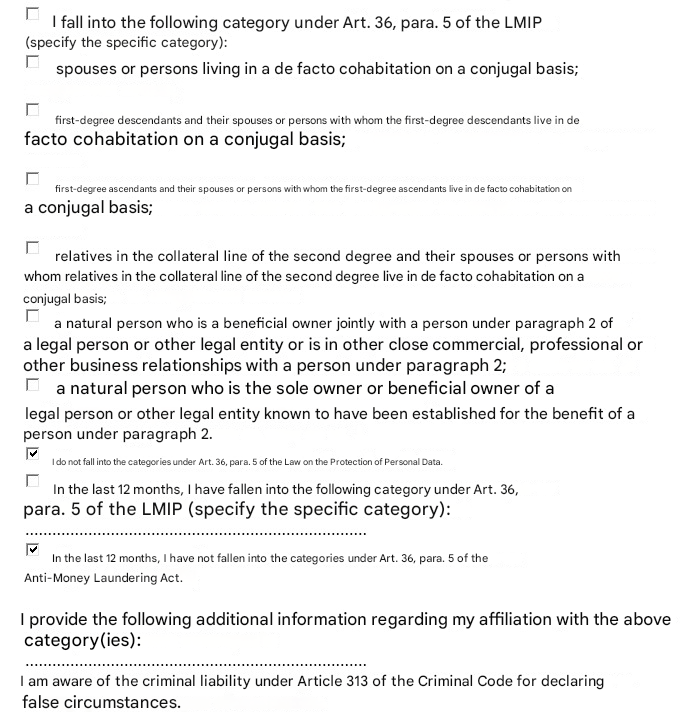

Declaration of Politically Exposed Person (PEP) Status

Under the law, politically exposed persons fall under a higher-risk category, and their transactions must be monitored more strictly. This declaration determines whether you or related persons fall under this definition.

The first part of the declaration should be easy to complete.

If you are a politically exposed person or connected to one, you will know which options to select. If not, simply tick the options we have marked in the example images above.