The quiet revolution in crypto that almost no one noticed...

You know how the internet started as something strange and slightly ridiculous?

Forums, slow websites, emails from Nigerian princes.

No one was saying:

“This will run the economy, commerce, and money.”

And then… we woke up in a world where everything runs through the internet.

Blockchain is following the exact same path.

Except most people are still looking in the wrong place.

While everyone argued about charts, something much bigger already happened

2025 was a strange year for crypto.

Prices – disappointing.

Alts – under pressure.

Sentiment – “bearish”.

And during all that, almost unnoticed:

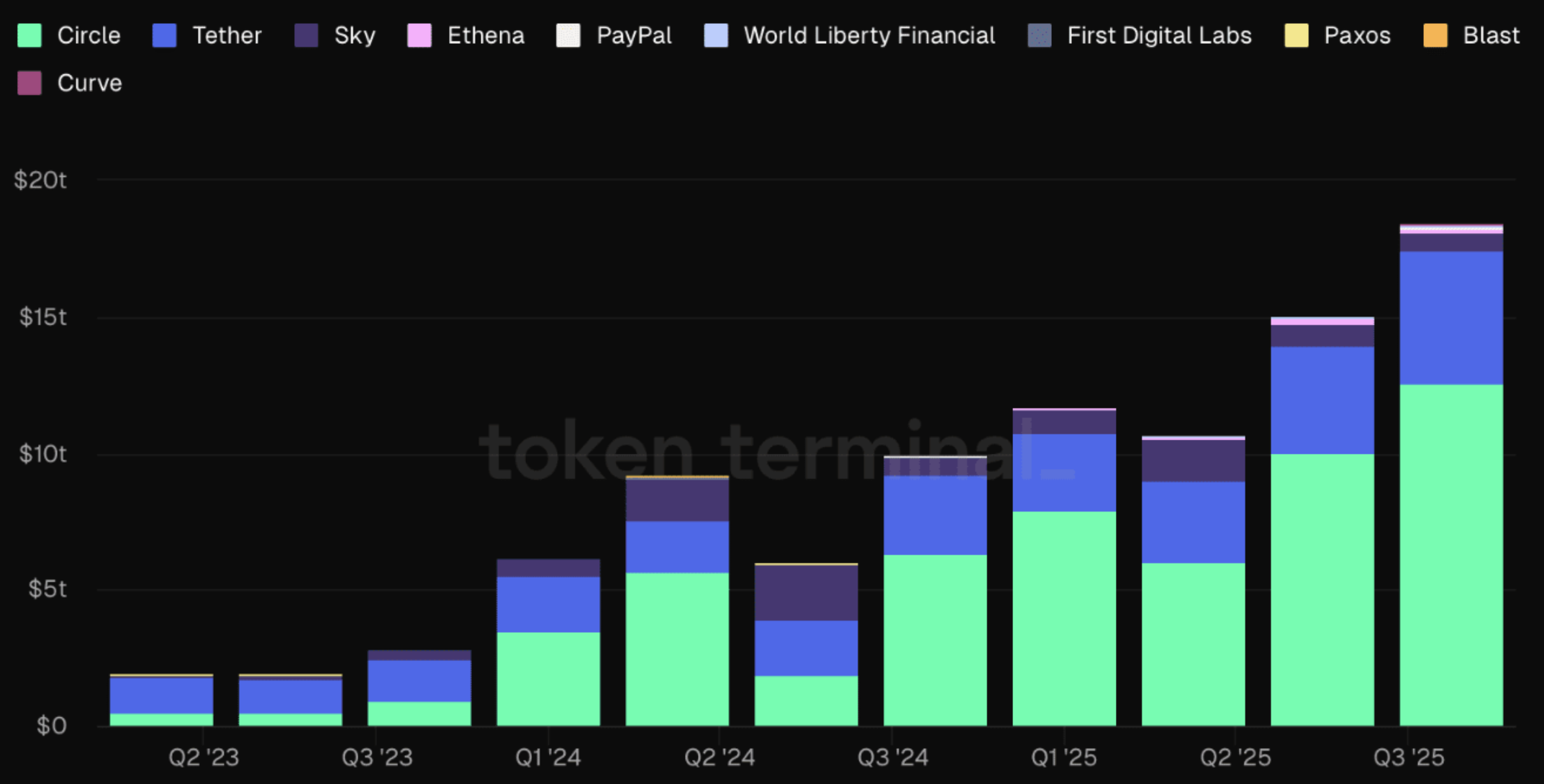

- Stablecoin transfers surpassed $55.8 trillion

(more than 3x Visa’s volume)

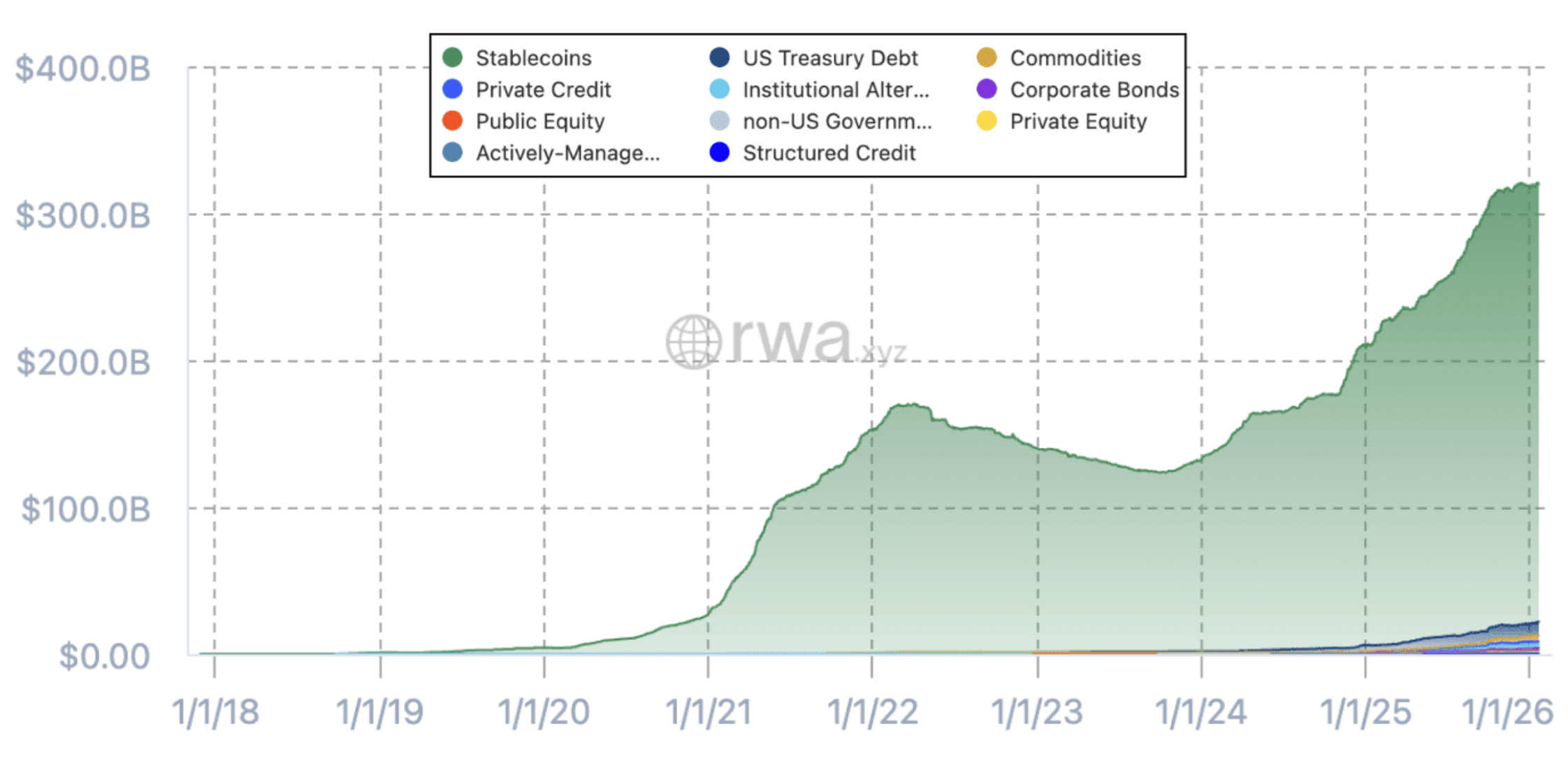

- Total stablecoin supply jumped from ~$200B to ~$300B

- Tokenized real-world assets grew more than 3.5x

This is not hype.

This is infrastructure.

While Twitter argued about “when altseason is coming”, the big players were already building.

The most important chart almost no one is watching

ARK Invest released a forecast that sounds unreal until you put it in context:

Tokenized Real World Assets (excluding stablecoins):

from ~$20 billion → ~$11 trillion by 2030.

And this is not a price prediction.

It is a forecast for the migration of real assets onto blockchain.

Money came first. Everything else followed.

Stablecoins were the test.

Can blockchain move real money, at real scale, without breaking?

We already know the answer.

Money:

- settles faster

- works 24/7

- moves with fewer intermediaries

And once that worked… institutions stopped watching from the sidelines.

BlackRock does not run experiments

While the market was busy wondering “when things will move”,

BlackRock already had $1.7 billion in a tokenized Treasury fund.

Tokenized gold followed the same path:

- XAUT

- PAXG

Not because crypto is cool, but because it works better.

This is not a trading story.

This is financial optimization.

The real explosion hasn’t started yet

Tokenized stocks?

Still under $1 billion.

Sounds small.

But that’s the same kind of “small” the internet was in 1998.

Once:

- regulations become clear

- infrastructure is ready

everything that can be split, transferred, and owned will be tokenized.

Real estate.

Private equity.

Funds.

Art.

Not because it’s trendy.

But because it’s more efficient.

And here comes the most interesting part

Even if ARK’s forecast comes true…

$11 trillion in tokenized assets… is just 1.38% of all global financial assets.

That means this is not the peak.

This is the beginning.

The conclusion most people will understand too late

2025 was not a lost year for crypto.

It was the year when:

- price action was boring

- but the foundations were poured

While the crowd watched charts, smart money was building.

And when all of this becomes visible…

there will be no time to catch up.

The question is not if.

The question is whether you will see it in time.