What is Bitcoin - Part 1

In recent years, more and more people have started to take an interest in cryptocurrencies, particularly Bitcoin and Ethereum. The possibilities in this niche are endless, but it is very new, different from anything people have encountered before, and therefore challenging to understand. Many myths have taken root in society, such as claims that cryptocurrencies are a scam, a pyramid scheme, or consume excessive energy. We hope you’ll stay and read this article to the end to understand what you’re dealing with and whether such claims are true.

Newcomers to the crypto world have many questions, which are entirely logical and simple to answer but unfortunately require a fair amount of time to explain. This is why we’ve created this section to introduce you to the basics.

This article uses resources from Bitcoin.org, so if you’re wondering where to continue reading, rest assured that visiting this site is a great choice!

Let’s get to the core of the matter:

What is Bitcoin?

Bitcoin is a consensus network that enables a new payment system and a completely new type of digital money. It is the first decentralized peer-to-peer (P2P) payment network, maintained by its users without a central authority or intermediaries. From a user’s perspective, Bitcoin is something like "internet money." Bitcoin can also be viewed as the most successful triple-entry accounting system known to date.

Who Created Bitcoin?

Bitcoin was the first to implement the concept of a "cryptocurrency," described in 1998 by Wei Dai. This concept proposed a new form of money that uses cryptography to control its creation and transactions, rather than relying on a central authority. The first Bitcoin specification and concept were published in 2009 in a cryptography mailing list by Satoshi Nakamoto. Satoshi left the project in late 2010 without revealing much about themselves. The community has seen significant growth since then, thanks to the many developers working on Bitcoin.

Satoshi’s anonymity often raises unwarranted concerns, many of which stem from a misunderstanding of the open-source nature of Bitcoin. The Bitcoin protocol and software are published openly, and any developer worldwide can review or create their own modified version. Just like current developers, Satoshi’s influence was limited to the changes they made that were adopted by other users, without controlling Bitcoin. Thus, uncovering the identity of Bitcoin’s inventor today is as relevant as identifying the person who invented paper—unnecessary.

Who Controls the Bitcoin Network?

Nobody owns the Bitcoin network, just as nobody owns the technology behind email. Bitcoin is controlled by all its users worldwide. Developers improve the network’s software, but they cannot force changes to the protocol because users are free to choose the software and version they use. For users to transact with each other, they must use software that adheres to the same rules. Bitcoin can only function with full consensus among all users. Therefore, all users and developers have a strong incentive to protect this consensus.

How Does Bitcoin Work?

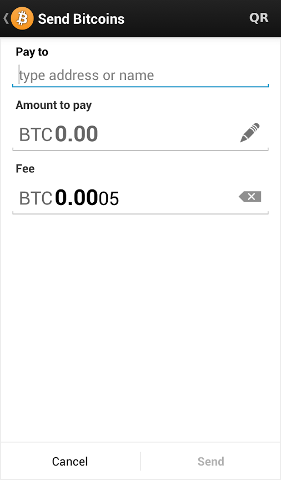

From a user’s perspective, Bitcoin is simply a mobile app or computer program that provides a Bitcoin wallet, allowing you to send and receive Bitcoins.

Behind the scenes, the network shares a public ledger called the "blockchain." This ledger contains every transaction ever processed, enabling a user’s computer to verify their validity. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, giving users full control over the Bitcoins leaving their accounts. Additionally, anyone can process transactions using the computational power of specialized hardware and earn Bitcoins for this service, known as mining.

Does Anyone Use Bitcoin?

Yes. There is a growing number of businesses and individuals using Bitcoin. This includes brick-and-mortar businesses like restaurants, shops, and law firms, as well as many popular online services. While Bitcoin remains a relatively new phenomenon, it is growing rapidly. Recently, El Salvador took steps toward adopting Bitcoin as an official currency for payments, becoming the first country to recognize it as legal tender. New companies are constantly emerging, investing parts of their portfolios in Bitcoin and even beginning to accept payments with it—Paypal and MasterCard are examples. There is also significant talk of interest from Google and Amazon.

How Can I Get Bitcoin?

There are several ways to acquire your first "satoshis" (a Satoshi is the smallest indivisible unit of Bitcoin; 1 Bitcoin equals 100 million Satoshis):

Accept payments in Bitcoin or provide a service for which you are paid in Bitcoin;

- Purchase from a Bitcoin exchange like Altcoins.bg;

- Exchange with someone nearby (P2P);

- Earn Bitcoin through mining.

How Do I Make a Bitcoin Payment?

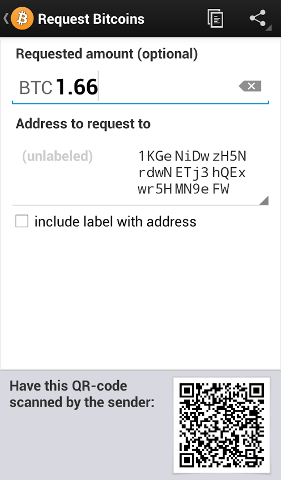

Bitcoin payments are easier to make than purchases with debit or credit cards and can be received without a merchant account. Payments are made from your wallet application on your computer or smartphone by entering the recipient’s address, the payment amount, and pressing the send button. To make entering the recipient’s address easier, many wallets can retrieve it by scanning a QR code or tapping two phones together using NFC technology.

What Are the Advantages of Bitcoin?

Monetary Freedom - You can send and receive various amounts instantly, anywhere in the world, at any time. There are no bank holidays, no borders, and no restrictions. Bitcoin allows its users to have full control over their money.

Low Fees - In the past, Bitcoin transactions were processed with no or minimal fees. Currently, the situation is quite different due to the network's growth and the wider audience using it for transactions. Nevertheless, for a $1,000,000 Bitcoin transaction, you might pay less than $5 in fees. Which banking system could offer that? We won’t even mention the paperwork you’d avoid.

Additionally, Bitcoin’s network includes merchant processors that convert Bitcoins into fiat currency և deposit funds daily into users’ bank accounts, facilitating transaction processing (e.g., Altcoins.bg).

Low Risks for Merchants - Bitcoin transactions are secure, irreversible, and do not contain sensitive customer information or personal data. This protects merchants from losses due to fraud or non-payment, without needing to comply with PCI standards. Merchants can easily expand to new markets where credit cards are unavailable or fees are prohibitively high. The net results are lower fees, larger markets, and reduced administrative costs.

Security and Control - Bitcoin users have full control over their transactions, making it impossible for merchants to impose unwanted or hidden fees, as can happen with other payment methods. Bitcoin payments can be made without linking personal information to the transaction, offering strong protection against identity theft. Bitcoin users can also safeguard their money with backups and encryption.

Transparent and Neutral - All information about Bitcoin is available on the blockchain and can be accessed and verified in real-time. No individual or organization can control or manipulate the Bitcoin protocol because it is cryptographically secured. This leads us to consider Bitcoin’s core as completely neutral, transparent, and predictable.

What Are the Disadvantages of Bitcoin?

Degree of Adoption and Acceptance - Many people are still unfamiliar with Bitcoin. Every day, more businesses accept Bitcoin to take advantage of its benefits, but the list remains small and needs to grow to fully leverage the network effect.

Volatility - The total value of Bitcoins in circulation and the number of businesses using Bitcoin are still small compared to their potential. Consequently, relatively minor events, trades, or business activities can significantly impact the price. In theory, volatility will decrease as Bitcoin markets and technology mature. The world has never seen such a currency before, so it’s challenging (and exciting) to predict how things will unfold.

Ongoing Development - Bitcoin’s software is still in beta, with many features incomplete but actively being developed. New tools, features, and services are being created around the clock to make Bitcoin more secure and accessible to the masses.

Why Do People Trust Bitcoin?

Much of the trust in Bitcoin stems from the fact that it requires no trust at all. Bitcoin is fully open-source and decentralized, meaning anyone can access the entire source code at any time. Any developer worldwide can verify how Bitcoin works. All transactions and Bitcoin issuance are transparent and traceable in real-time. Payments can be made without relying on a third party, and the entire system is protected by thoroughly reviewed cryptographic algorithms, similar to those used in online banking. No organization or individual can control Bitcoin, and the network remains secure even if not all users can be trusted.

Can I Profit from Bitcoin?

You shouldn’t expect to get rich with Bitcoin or any emerging technology. It’s crucial to be cautious of anything that sounds too good to be true or disregards basic economic principles. Bitcoin is a growing space of innovation with business opportunities that carry risks. There’s no guarantee that Bitcoin will continue to grow, despite its rapid development and exponential price surges so far. Investing time and resources in anything Bitcoin-related requires entrepreneurial spirit. There are various ways to make money with Bitcoin, such as mining, speculation, or starting a new business. All these methods are competitive, with no guaranteed profit. Each individual must carefully assess the costs and risks associated with such projects.

Is Bitcoin Entirely Virtual?

Bitcoin is as virtual as credit cards and online banking used daily. It can be used for online payments and in physical stores, just like any other form of money. Bitcoins are stored in a vast network and cannot be fraudulently altered by anyone. In other words, Bitcoin users have exclusive control over their funds, and Bitcoins cannot vanish just because they are virtual.

Does Bitcoin Exist If It’s Only Virtual?

Bitcoin is virtual, like any software you use on your computer. Have you ever physically touched an email or a program like Photoshop? Yet, do you doubt their existence? No, the moment you receive an email, you know it exists. Similarly, when you see a photo on social media, you don’t question its reality. The same applies to Bitcoin! The internet and email took about 20 years to establish themselves as widely usable technologies. Before that, they faced the same stereotypes Bitcoin encounters today.

Is Bitcoin Anonymous?

Bitcoin is designed to allow users to send and receive payments with an acceptable level of privacy, similar to other forms of money. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. Bitcoin usage leaves extensive public records. Various mechanisms exist to protect users’ privacy, with more in development. However, significant work remains before these features are widely and correctly used by most Bitcoin users.

What Happens When Bitcoins Are Lost?

When a user loses their wallet, it’s akin to removing money from circulation. Lost Bitcoins remain in the blockchain like any other, but they stay dormant forever because no one can retrieve the private key. According to the law of supply and demand, when fewer Bitcoins are available, demand for the remaining ones increases, raising their value.

Can Bitcoin Become a Major Payment Network?

This process has already begun. The Bitcoin network can process far more transactions per second than before, but it’s not yet ready to match the scale of major credit card networks like Visa and MasterCard. Efforts are underway to remove these limitations, and future requirements are clear. Since its inception, every aspect of the Bitcoin network has been in a continuous process of optimization, specialization, and development, expected to continue for years as traffic grows. With the introduction of the Lightning Network, there’s now an option for fast and free transactions outside Bitcoin’s main network.

Is Bitcoin Legal?

To our knowledge, Bitcoin is not prohibited by legislation in any country. However, some jurisdictions (e.g., Argentina and Russia) strictly limit or ban the use of foreign currencies. Others (e.g., Thailand) may restrict licensing for entities like Bitcoin exchanges. Regulators in various jurisdictions are taking steps to provide individuals and businesses with rules on integrating this new technology into the formal regulated financial system. For example, the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) issues non-binding guidance on characterizing certain activities involving virtual currencies.

In recent months, more countries have begun regulating Bitcoin. This is crucial, as nations are embracing and incorporating it into their legislation rather than attempting to ban or stifle it. The network is now too large to ignore.

Is Bitcoin Used for Illegal Activities?

Bitcoins are money, and money has always been used for both legal and illegal purposes. Cash, credit cards, and current banking systems far surpass Bitcoin in their use for funding crime. Bitcoin can bring significant innovation to payment systems, with benefits that outweigh potential drawbacks. It’s designed to be a major step forward in securing money and can serve as protection against many forms of financial fraud.

For instance, it’s impossible to counterfeit Bitcoins. Users fully control their payments, and unauthorized fees, like those in credit card scams, cannot be imposed. Bitcoin transactions are irreversible and protected against chargebacks. Bitcoin allows you to safeguard your money against theft or loss using proven mechanisms like backups, encryption, and multi-signature.

Concerns have been raised that Bitcoin might be more attractive to criminals due to its potential for private and irreversible payments. However, it’s worth noting that Bitcoin will undoubtedly be subject to regulations similar to those in existing financial systems. It cannot be more anonymous than cash and cannot prevent criminal investigations. Moreover, no one can block access to your Bitcoin wallet, unlike other existing monetary assets.

Can Bitcoin Be Banned or Regulated?

The Bitcoin protocol cannot be altered without the cooperation of nearly all its users, who choose which software to use. Attempting to assign special rights at a local level within the global Bitcoin network is impractical. A wealthy entity could invest in mining hardware to control half the network’s computational power and block or reverse recent transactions. However, there’s no guarantee they could maintain this power, as it requires investments exceeding those of all other miners combined. Bitcoin’s use can be regulated similarly to any other tool. Like the dollar, Bitcoin can be used for a wide range of purposes, some deemed legal or illegal depending on each jurisdiction’s laws. In this regard, Bitcoin is no different from any other tool or resource and can be subject to varying regulations in each country. Restrictive regulations could hinder Bitcoin’s use, making it hard to predict what percentage of users would continue using the technology. A government banning Bitcoin would deprive local businesses of access to markets and emerging innovations in other countries. The challenge for regulators, as always, is to develop effective solutions without stifling the growth of new, rapidly evolving markets and businesses.

Bitcoin and Consumer Protection?

Bitcoin allows individuals to transact on their own terms. Each user can send or receive payments similar to cash, but they can also engage in more complex contracts. Multi-signature allows a transaction to be accepted by the network only if a specific number of people from a defined group agree to sign it. This paves the way for innovative dispute resolution services. Such services enable a third party to approve or reject a transaction in case of disagreement between other parties without controlling their funds. Unlike cash and other payment methods, Bitcoin always leaves a publicly accessible trace of a transaction, which can potentially be used to seek compensation in disputes involving fraudulent business practices. It’s also worth noting that while merchants typically rely on their public reputation to stay in business and pay employees, they lack the same level of information when dealing with new consumers. Bitcoin’s operation protects both individuals and businesses from fraudulent chargebacks while giving them the choice to request greater protection when they are unwilling to trust a particular merchant.

How Are New Bitcoins Created?

New Bitcoins are generated through a competitive and decentralized process called mining. This rewards network users for their services. Bitcoin miners process transactions and secure the network using specialized hardware, earning new Bitcoins in return. The Bitcoin protocol is designed so that new Bitcoins are created at a fixed rate, making mining a highly competitive business. As more miners join the network, profitability becomes harder, and miners must seek efficiency to cut operational costs. No central authority or developer has the power to control or manipulate the system to increase miners’ profits. Every Bitcoin node worldwide will reject anything that doesn’t comply with the system’s expected rules. Bitcoins are created at a decreasing and predictable rate. The number of new Bitcoins created annually halves over time (called halving) until issuance stops completely at 21 million Bitcoins in circulation. At that point, Bitcoin miners will be supported solely by numerous small transaction fees. However, the network will be so large that this will be sufficient to maintain the competitiveness of the mining business.

Why Does Bitcoin Have Value?

Bitcoins have value because they are usable as a form of money. They possess the characteristics of money (durability, portability, fungibility, scarcity, divisibility, and recognizability) based on mathematical properties rather than physical ones (like gold and silver) or trust in centralized institutions (like fiat currencies). In short, Bitcoin is backed by mathematics. With these qualities, all that’s required for a form of money to hold value is trust and adoption. For Bitcoin, value can be measured by the growing number of users, merchants, and startups. As with all currencies, Bitcoin’s value comes solely and directly from people willing to accept it as payment.

What Determines Bitcoin’s Price?

A Bitcoin’s price is determined by market supply and demand. When demand for Bitcoins rises, the price increases; when demand falls, the price decreases. There’s a fixed number of Bitcoins in circulation, and new ones are created at a predictable and decreasing rate, meaning demand must match the level of inflation to keep the price stable. Given that Bitcoin is still a small market compared to its potential, it doesn’t take a colossal amount of money to move the price up or down, which is why it remains volatile.

Can Bitcoin Lose Its Value?

Yes. History is full of examples of currencies collapsing and no longer being used, such as the German Mark during the Weimar Republic or the Zimbabwean Dollar. While currency collapses are often due to hyperinflation, which is impossible with Bitcoin, there is always the potential for technical failures, the emergence of superior competing currencies, political issues, and so on. As a general rule, no currency is immune to collapse or fluctuations. Bitcoin has proven its stability over the years since its creation and has immense potential for growth. However, no one can predict Bitcoin’s future.

Is Bitcoin a Bubble?

A rapid price increase cannot be defined as a "bubble." Artificial overvaluation leading to a sudden drop constitutes a bubble effect. The choices driven by the individual actions of hundreds of thousands of market participants cause Bitcoin’s price to fluctuate as the market seeks its true value. Reasons for changes in sentiment may include loss of confidence in Bitcoin, a significant gap between value and price not based on the fundamentals of the Bitcoin economy, increased pressure to fuel speculative demand, fear of uncertainty, or old-fashioned irrational exuberance and greed.

Is Bitcoin a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment operation that pays returns to investors from their own money or funds from new investors, rather than from profits earned by the business operators. Such schemes collapse when there are not enough new participants, leaving the last investors as victims. Bitcoin is a free software project with no central authority. Therefore, no one can make fraudulent claims about investment returns. Like other major currencies such as gold, the dollar, euro, yen, etc., there are no guarantees of purchasing power, and the exchange rate fluctuates freely. This leads to volatility, where Bitcoin owners can unpredictably gain or lose money. Beyond speculation, Bitcoin is a payment system with useful and competitive qualities used by thousands of users and businesses.

Doesn’t Bitcoin Give More Privileges to Early Adopters?

Some early adopters hold large amounts of Bitcoins because they took risks and invested time and resources in an unproven technology that was difficult to use and secure. Many spent significant amounts of Bitcoins before they became valuable, made small purchases, and did not realize substantial profits. There is no guarantee that Bitcoin’s price will rise or fall. This is similar to investing in an early-stage project that may gain value and popularity or fail to break through. Bitcoin is still in its infancy and designed with a long-term perspective. It’s hard to imagine it was created to favor early adopters, just as it’s uncertain whether those joining now will be the winners in the future.

Won’t Bitcoin Fall into a Deflationary Spiral?

The deflationary spiral theory suggests that if prices are expected to fall, people delay purchases to benefit from lower prices. This drop in demand prompts merchants to lower prices to stimulate it, exacerbating the problem and leading to economic depression. Although this theory is a popular way to justify inflation among central banks, it’s not always true and is considered controversial among economists. Consumer electronics is an example of a market where prices consistently fall without being in depression. Similarly, Bitcoin’s value has risen over time, yet the size of the Bitcoin economy has grown dramatically alongside it. Since both the currency’s value and the economy started from zero in 2009, Bitcoin is a counterexample to the theory, showing that things can work differently. That said, Bitcoin is not designed to be a deflationary currency. It’s more accurate to say Bitcoin is intended to inflate in its early years and stabilize later. The only scenario where the number of Bitcoins in circulation would decrease is if people carelessly lose their wallets without backups. With a stable monetary base and economy, the currency’s value should remain consistent.

Isn’t Price Speculation a Problem?

It’s like the eternal question of the chicken or the egg. For Bitcoin’s price to stabilize, a large-scale economy with many businesses and users must develop. For such an economy to emerge, businesses and users need price stability. Fortunately, volatility doesn’t affect Bitcoin’s core benefits as a payment system for transferring money from point A to point B. Businesses and individuals can instantly convert Bitcoin payments into their local currency, allowing them to benefit from Bitcoin’s advantages without being affected by price fluctuations. Bitcoin offers many useful and unique features, and many users choose to use it. With such solutions and incentives, Bitcoin can mature and develop to a point where price volatility becomes limited.

What Happens If Someone Buys All Existing Bitcoins?

Only a small fraction of Bitcoins in circulation are available for sale. Bitcoin markets are competitive, meaning their price rises or falls based on supply and demand. Moreover, new Bitcoins will continue to be issued for decades. Thus, even the most determined buyer cannot purchase all existing Bitcoins. However, this doesn’t mean markets are immune to price manipulation, as a relatively small amount of money can still shift the market price in either direction. This is why Bitcoin remains a highly volatile asset for now.

What If a Better Digital Currency Is Created?

That could happen. For now, Bitcoin remains far ahead of the most popular decentralized virtual currencies, but there’s no guarantee it will maintain this position. There are already alternative currencies inspired by Bitcoin. However, as you might correctly assume, they need significant improvements to surpass Bitcoin in terms of market establishment, though this remains unpredictable. Bitcoin can also adopt improvements from competing currencies as long as they don’t alter the protocol’s core components.

How Are Transactions Confirmed in the Network?

Receiving a Bitcoin payment is almost instantaneous. However, there’s an average 10-minute delay before the network begins confirming your transaction by including it in a block and before you can spend the received Bitcoins. Confirmation means there’s a network consensus that the Bitcoins you received haven’t been sent to anyone else and are considered yours. Once a transaction is included in a block, it will remain under every subsequent block, progressively consolidating this consensus and reducing the risk of a reversed transaction. Each user can decide when to consider a transaction confirmed, but six confirmations are often deemed as secure as waiting six months for a credit card transaction.

How Much Is the Transaction Fee?

The fee for confirming a transaction on the Bitcoin network constantly changes and depends on the number of payments miners need to process at that moment. You can track the current fee on sites like mempool.space, which lists the recommended fee for timely transaction processing and the number of pending payments in the queue, called the mempool. Just as Bitcoin mining is a competitive environment, so are network transactions. You’re competing with other users for your transaction to be included in the next block. You can send a transaction without a fee, but it’s likely to be processed after a very long time.

Can I Receive Bitcoin If My Wallet Is Offline?

No problem. The Bitcoins will appear the next time you launch your wallet application. They aren’t actually received by the software on your computer but are appended to the public ledger shared across all network devices. If Bitcoins are sent while your wallet client is offline and you later launch it, it will download blocks and catch up with any missed transaction data. Eventually, the Bitcoins will appear as if received in real-time. Your wallet is only needed when you want to spend Bitcoins.

This concludes the first part of the article. To read about Bitcoin mining, network security, whether it consumes excessive resources, and whether it can be hacked, check out:

Introduction to Bitcoin and Cryptocurrencies - Part 2

Source: We remind you again that much of this information is sourced from bitcoin.org. Don’t miss visiting the site to continue your Bitcoin education.